What is the economic cycle? Business cycles and their types

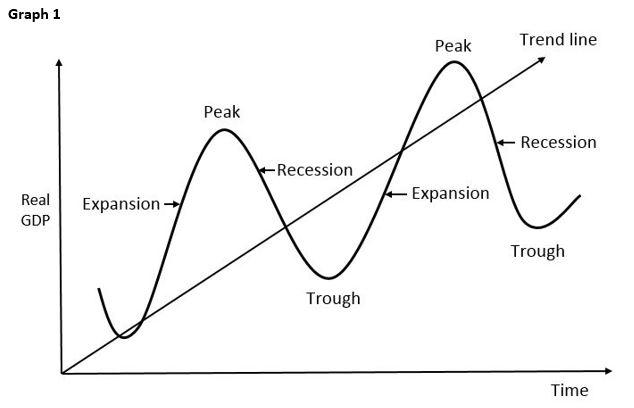

The economic cycle is a natural market vibration between the periods of expansion and recession. It is a useful tool when you want to analyze the financial situation. The business cycle has four stages: expansion, crisis, recession, recovery. The first stage occurs when the economy grows. It ends with the overheating. The economic crisis (or the peak) begins. The phase of crisis rapidly transits into a recession. It’s is the most negative phase because the GDP growth falls and the rate of unemployment starts to rise. The last stage of the scale is recovery. The recovery period is the end of a recession.

Economists identified different types of economic cycles as below:

- Kitchin short cycle (2-3 years);

- Juglar cycle (6-13 years);

- Kuznets cycle ( 15-20 years);

- Kondratiev waves (48-55 years).

Kitchin cycle is a short business cycle, discovered by Joseph Kitchin in the 1920s. This short cycle can be explained as the cycle with time lags in information movements, influencing the decisions, made by commercial firms. First, firms react to the business situation improvement, increasing production for the cost of full employment of primary capital assets. As a result, during a specific period, a market becomes full of excessive goods. Then, prices fall, demand declines, it takes time for entrepreneurs to check the market situation, and to reduce firms production. Another time lag is the lag between their decision and the decrees of the excessive goods amounts.

The Juglar cycle is a fixed investment cycle identified by Clément Juglar in 1862. In the Juglar cycle vibrations of investments into a necessary capital can be observed. As a result, the time lags also add lags between investment decisions and the construction of appropriate production facilities. Cyclic economic crises, recessions can be considered as one of the phases of the Juglar cycle (along with the recovery, recovery and depression phases).

Kuznets cycle is a medium-range economic wave, opened by Simon Kuznets in 1930. Kuznets connected these waves with demographic processes and called them “demographic” or “building” or building cycles/swings. At present, they considered as technological cycles. In the frames of these cycles is a massive renewal of technologies.

Kondratiev waves are ups and downs of the modern global economy, described by Nikolai Kondratyev in 1920. Such cycles are the long economic cycles in history. The conception includes several ups and downs of the four economic phases. Some researchers associate the change of waves with technological structures. Technologies open possibilities for expansion of production and form a new technological mode.

Economic cycles. Economists’ thoughts and predictions about periods. Is there a way to predict the cycle?

It’s tough to compare the current economic cycle with the previous ones, because of the financial crisis, zero interest rates, quantitative easing and, financial boost. One of the brightest events of the current cycle is the increasing Technologies profit in the conditions of the weak growth profit in other life spheres. Scientists believe that the recession won’t observe in the nearest future. Probably, in the next 3-5 years, the market environment will be more regular. The “Growth” as an economic factor looks very expensive. Economists focus on companies that are reinvesting in the future. They also like the idea of Technologies boom. Economists distinguish about six indicators that can forecast the current situation of the economic cycle: an unstable market, Fed’s raises rates, the Treasury yield curve, leading indicators decline, working hours, consumer spending declines.

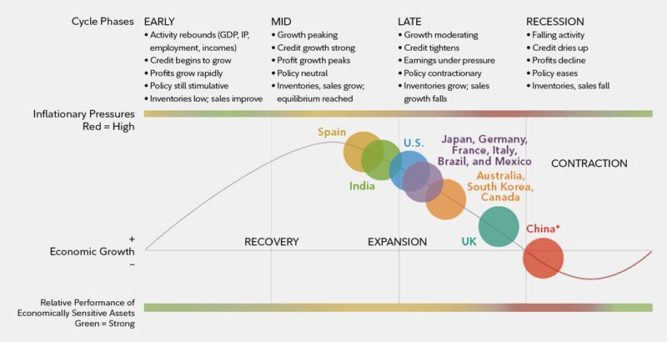

Late – cycle for longer? Where are we in the period nowadays?

As we can know from Goldman Sachs global investment research, the USA is in “late-cycle” of economic expansion that lasts for eight years. The risk of recession nowadays is very low. Due to 10 year, Treasury yields the worlds “no recession” “no correction” form the top mind. Resection is unlikely to happen before 2019-2020. But thoughts differ, because of the market risks today and what to do about it.

Different industries follow different cycles

Every industry has to go through its private life cycle. Let’s compare some industries and their economic cycles. The most vulnerable sector is Construction. Workers and builders, connected with building and a huge production suffer most of all during the period of recession. Enterprise repairs equipment and sets it in motion on the market. But people can’t buy durable goods, because of the budget cut. As a result, such industries like building, engineering, auto, aviation remain unclaimed.

Conversely, industries that produce durable goods in the recovery period receive the maximum stimulants for the development. The healthcare sector includes two main industry groups. The first group takes in medical services; the second group does researches, production, and marketing of pharmaceuticals and biotechnology goods. Healthcare buyers spend money on medicine during the recession period. Due to the public cost-cutting, the country’s mortality rates become lower, whereas private cutbacks increase the long-term growth in total healthcare expenditures. Individual cost cuts during the recession are smaller in countries with an excellent financed healthcare system and more prophylactic public activities. The consumer staples sector includes companies whose business is less vibrant to business cycles. The industry includes makers and traders of food, beverages and tobacco, non-durable household goods and personal products.

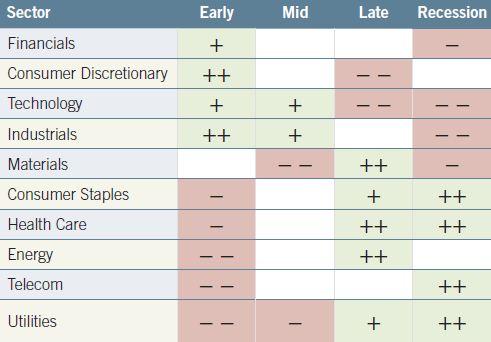

Early&Late cycles and industries

If we compare early&late cycles, we’ll see that an early-cycle phase occurs when the economy recovers from recession. Early periods include such sectors as cyclical, and financials. A late-cycle phase appears when economic growth becomes slower and inflation climbs higher. Late-cycle industries include energy, healthcare, utilities, and consumer’s goods.

The Three Waves of the Financial Crisis

There are three waves of the global economic crisis. The first wave of crisis started in the USA (2008-2009) with the housing market collapse, spread into a credit crunch and finished with the Lehman collapse. The second wave started in Europe (2010-2012) with the losses of bank credits in the Us, spread to a sovereign world crisis and ended with the Outright Monetary Transactions(OMT) of the ECB liability to do “whatever it takes”, and with the introduction of Quantitative Easing (QE). The third EM wave (2014-2016), coincided with the collapse of commodity prices, and during 2013-2016 it was hard with trade there. Such waves became global. The whole world suffered from the crisis until the recovery period. Since the middle of 2016, all equity markets have moved higher together. The market moved on a weak growth with declines of bond yields and inflation expectations.

Bear and bull markets

A bear market is a condition of a market that characterizes with a period when prices are falling. There are several indicators, which point on the bear market risks.

The growth of bear markets triggers with the rising of interest rates, and higher inflation in the past years. Such type of market can “rebase” its valuations, and quickly recovers. A long period of low returns characterizes with low returns in the market without a clear trend. Inflation and the rise of interest rates played an important role in the bear markets for the past cycles. Without tightening of monetary policy in the future – risks of a “cyclical” bear market are much lower.

Economists founded out that there are good examples for long cycle expansions such as the UK from 1992 to 2008, Canada from 1992 to 2008 or Japan from 1975 to 1992. They think that powerful economy regulations, the absence of imbalances on the markets are significant indicators of a continued economic cycle. But economists mark that due to a massive fiscal tightening, tighter financial conditions and supply constraints there is still a high risk of a technical recession in 2020-2021 in the USA. What about Europe? Europe has a very high risk of inflation, therefore, higher interest rates. The recession in the nearest future is unlikely to happen.

A bull market is a market where the prices rise. The “bull market” often determines a stock market but can be used to such terms as bonds, commodities, real estate, currencies. The term “bull market” is oriented for long periods, mainly because a significant part of prices on securities is rising. Economists are quite optimistic with bull markets, and it’s difficult to define which economic factor can break the stability.

Bull and bear markets often coincide with the economic cycle. The onset of a bull market coincides with the economic expansion. Bear markets, usually set in before the economic contraction goes to the recession. If investors want to have profited from the bull market they must buy when prices are growing and sell when they rich the peak. The most USA fruitful market observed from 1982 to 2000. Then time for the bear markets started.

Skinny & Flat and Fat & Flat markets

There are two types of flat markets:

- Skinny & Flat markets (low volatility, low returns) are markets where the equity prices stuck in a narrow diapason.

- Fat & Flat markets (high volatility, low returns) – are long periods, when equity indices make minimal common progress with strong corrections.

There is no simple factor to mark out a particular economic cycle of skinny&fat markets. It’s difficult to identify on what date they start and finish. But economists find out some good examples of flat and skinny markets periods. There were about seven markets in the USA after World War II and, ten in Europe, since 1970.

The economic cycle is at the stage of expansion now. It’s complicated to compare the current economic situation with previous ones. We should consider the financial crisis and the following aggressive easing policy. It was the weakest economic recovery during the last sixty years. The boom of the Technology sector in the conditions of weak profit growth is one of the great openings of the current business cycle. The divergence between Technology and the rest of the world also explains the unusual situation of the USA equity market. Rising valuations and a tight labor market have contributed to a sharp rise in the Bull/Bear market’s indicator. High costs imply the risk of a bear market or a period of low returns over the next five years. Economists believe that the recession is unlikely in the near term. Financial imbalances eased over the past decade. A more likely alternative would be a “Skinny & Flat” market: a period of low returns in a narrow trading range. A flatter market environment over the next 3-5 years is likely and research shows that certain growth stocks will still perform well.

Recent Comments