Every new generation changes the world around and pushes it forward. It is the truth and the postulate of the existence of all humanity. We grow, we develop, and change the universe around us. What has been crucial several years ago, nowadays seems unnecessary, and vice versa, today we can’t imagine our life without things that even haven’t exist a couple of years ago. Humanity is changing, and it is normal, all the generations are influencers who decide what to save and develop and what is already wholly needless. To date is the epoch of the Millennials’ flourishing and, of course, it has already made its adjustments in our everyday life and continue to change things around us. In this article, we are going to talk about food. Or rather, about the changes in the food industry caused by the millennials’ influence. Which companies are close to reaching the top of their success and which are sentenced to the bankruptcy? Let’s check the statistics and evaluate the main parameters that are valuable and decisive in the food industry nowadays.

Small vs. big brands. Who will win the battle?

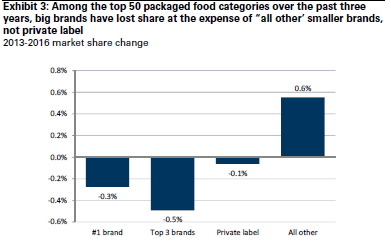

According to statistical data, to date is the period of the small brands’ superiority. They are noticeably outpacing not only the large brands but the private labels also. The direction of such development will be maximally clear when we focus on the fifty packaged food categories that nowadays drive more than 80{3fbfd6f1e6b19884051837dbbbebf333964dd5fac151615ffbd47b80e5ecc87a} of all industry sales. Different factors can cause such rise of the small brands and fall of the big brands. Specialists claim that among the main influencing factors may be:

- No barriers to distribution. “The more differentiated, the better” – this is the main motto of the many retailers today. They are aimed at the differentiation their goods from the competitors and are actively encouraging small brands to broaden the assortment and expand the customers’ preferences.

- No barriers for the brand awareness and interest. Due to the rapid development of social connectivity through digital platforms, brands nowadays don’t have to struggle for recognition. The social connectivity has facilitated not only the rapid spread of recognition but also peer endorsement for brands. To date, it is no need in the multi-million dollars mass media campaigns – the digitization of media has put both small and large brands into the same conditions.

- The too intense focus on margins. The food industry over the recent years has set the margins expansion as one of the primary goals. According to specialists, such intense focusing has noticeably increased the vulnerability of large brands. In most cases, the margins expansions have been performed by the brand investment. Nowadays, the expenses of brands for traditional advertising have significantly decreased, what caused the long process of establishing the cost of the food by big companies. As a result, the prices for lots of products are often seen as too high by consumers and are not supported by the brand investment at the desired level.

- Psychological factor. Most probably, it isn’t the most decisive factor, but it still might be the case. The consumers’ psyche may be directed at the support of smaller brands just because of the big brands’ distraction. In addition to this, lots of Millennials contribute to the expansion of the anti-establishment movement, that also may cause a negative influence on the scalable brands’ popularity and become one of the reasons of their weakness.

10 Facts about Millennials and food

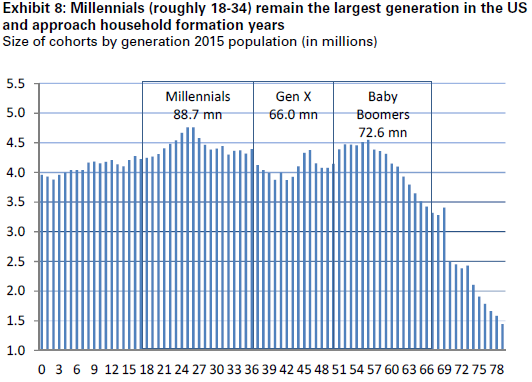

For today, Millennials are considered to be the largest population by size. And the most exciting and influencing fact is that the peak age of this generation is approaching household formation years. It will cause a noticeable growth in the household size, while the larger households will cause more considerable food expenses. Nowadays, the peak of the household is in the age of 35-44 years. It is not so difficult to calculate that the oldest Millennium has already entered this age. According to statistics, the increase of more than 70{3fbfd6f1e6b19884051837dbbbebf333964dd5fac151615ffbd47b80e5ecc87a} in the food sales is expected when the consumers will move from the 20-34 years group to the 35-44 years one, thus when they entered the household formation period. Basing on this forecast, we can suggest that during the next decade, Millennials will drive the wholeness food industry growth, changing the economics significantly. From the first view, it may seem like an excellent opportunity for the food industry. Yes, it is so, but it is also a high risk – according to the recent results, lots of industry leaders aren’t prepared and positioned well enough to get the benefits from it.

An interesting study, clearly showing the current situation has been performed by Goldman Sachs and Conde Nast’s Food Innovation Group. In this study, 7555 US citizens have been interviewed. Among all the respondents were 1076 consumers from the Millennial generation, 564 of which were considered as the “Food Influencers” because of their passion and interest in food, restaurants, cooking, and food experience. All the consumers were polled on their usage habits and brand association across 35 attributes for 172 brands. Basing on the results the researchers have got, and merging them with the self-reported data, they got an affinity ranking for all the 172 brands as well as the attribute correlation with growth. Let’s take a look at the results obtained and evaluate ten facts about Millennials and food:

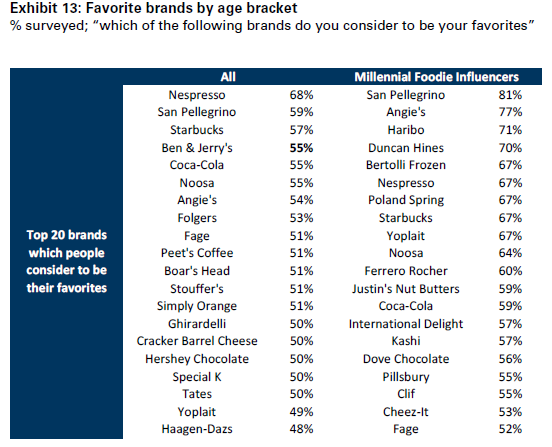

- Big brands are still at the top. Even taking into account the assumption about the brands’ indifference, the interviewed Millennials put the big brands at the top of the list, demonstrating a broader-based affinity to the big well-known brands.

- Increased appetite as the opportunity for smaller brands. At the top of the ranking, there were also small and mid-sized brands competing at the premium level of their respecting categories. Among these brands were both health-oriented (such as Noosa and Justin’s Nut Butters) and indulgent attributes (such as Starbucks and Ferrero Rocher).

- More snacks! As it turned out, most of Millennials still can’t imagine their life without snacks. Among the twenty influencer brands in the “Love list of Millennials,” the first eight positions have been occupied with the snack brands, among which Angie’s and Haribo placed first and second place respectively.

- If chocolate, then only premium. When choosing among the mainstream and premium brands, Millennials stopped their choice at the premium ones. The main favorites for respondents were such brands as Ferrero Rocher and Mar’s Dove. At the same time, mainstream-oriented Hershey didn’t make the TOP 20 list.

- If coffee, then only premium, but water still at the top. Such world-famous coffee brands as Starbucks and Nespresso are undoubtedly trendy, but surprisingly the first place was occupied by … water. Yes, the San Pellegrino has proudly ranked first place, while the Poland Spring also was not far behind and took the fifth place in the rating.

- Ice cream among the lagging ones. Although the national sample set has ranked Ben & Jerry’s and Haagen-Dazs among the top brands, according to the results obtained from the study, none ice cream brands entered the list of favorite Millennials’ brands.

- Baking forever. Unlike ice-cream, already two baking brands have been ranked among the TOP 20 favorite ones. PF’s Duncan Hines and SJM’s Pillsbury occupied fourth and thirteenth positions respectively.

- Yogurt among the top products. The youngest brand which has entered the “Love list” was yogurt brand Noosa, founded not so long ago (2010 year). Among its main competitors in this rivalry were another two brands – Fage and Yoplait that have also entered the list of “the best ones.”

- Cookies and crackers no longer in trend. None of the cookies brands has entered the TOP 20 list even despite the massive popularity of MDLZ’s most well-known brand – Oreo. Crackers are still kept afloat but are at the quite risky level also. The only brand which has occupied the 19th position in the list is Cheez-It.

- Common attributes rule the industry. Casting aside the brand names and making a consistent pattern of all the qualities that unite all the Millennials’ favorite brands together, the following characteristics can be “the key to success of the brand”:

- Good tasting;

- Easy to find;

- Consistent;

- Convenient;

- Good value.

According to the results obtained by this survey, it turned out that it doesn’t matter how popular and well-known brand is, if it corresponds the key attributes, it has all the chances to become the favorite of the Millennial generation.

Do the large brands still have a chance?

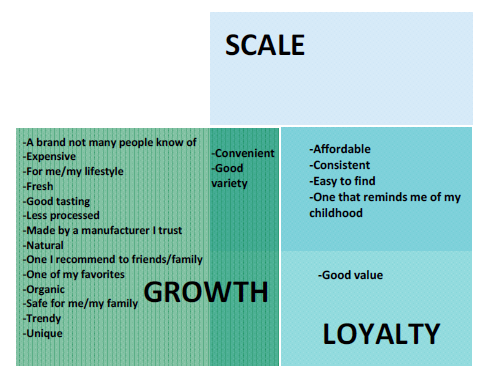

According to such measures as the affinity and purchase behavior, the conclusion is that the large brands are still relevant among the Millennials. However, this promising from the first view fact doesn’t provide us with any information about the subsequent growth or lack thereof. To more or less evaluate it, the researcher group has merged Nielsen data to align brand attributes across realized growth, sales level, and loyalty with the Millennials’ sample sets. For both of them, such characteristics as affordability and consistency were among the non-negotiable ones when it comes to establishing a large brand. In addition to this, the sales growth was strongly correlated with the “unique,” “trendy,” and “innovative” attributes.

All these attributes may seem basic and obvious, but they are among the main strength of any brand. Unfortunately, brands neglect them in modern consumer communication. Instead of this, the industry is focusing on transparency, authenticity, and natural/clean ingredients. Maybe the way to success is easier than it seems?

Recent Comments