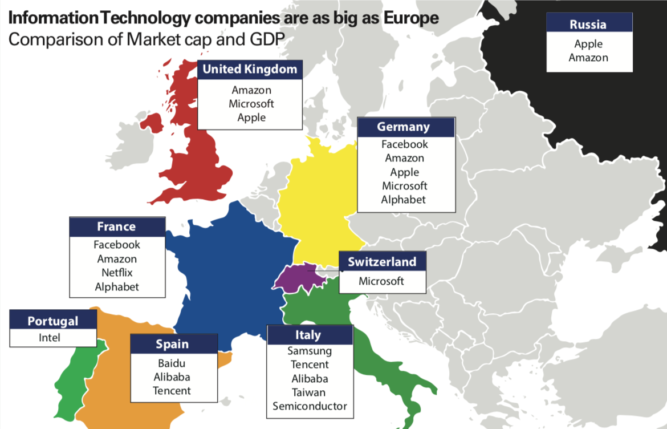

The market capitalization of the biggest Technology companies is roughly equal to the GDP of many European countries. For example, Market capitalisation of Microsoft approximately equals to GDP of Switzerland, and combined market capitalization value of Amazon, Microsoft and Apple equals to GDP of The United Kingdom.

In conditions of several economic crises that have already stressed world’s economy in the 21st century, many economists are genuinely worried if the most prominent information technology companies are not another bubble, the collapse of which can stress the market yet another time.

The development of the sector happens so rapidly, that it’s hard to predict the course of its further changes, however, some tendencies are already apparent.

Incredible Success of Technology Companies

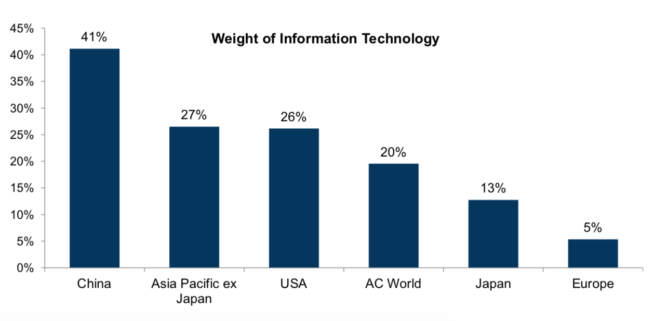

The Technology sector is mainly represented by the companies from the USA and China. The Tech industry is distributed very unevenly throughout the planet. For example, China has 41{3fbfd6f1e6b19884051837dbbbebf333964dd5fac151615ffbd47b80e5ecc87a} of its market capitalisation in the Technology field, the USA has 26{3fbfd6f1e6b19884051837dbbbebf333964dd5fac151615ffbd47b80e5ecc87a}, and Europe – only 5{3fbfd6f1e6b19884051837dbbbebf333964dd5fac151615ffbd47b80e5ecc87a}.

The concentration of the largest stocks is distributed very unevenly – Top 5 IT companies cover 60{3fbfd6f1e6b19884051837dbbbebf333964dd5fac151615ffbd47b80e5ecc87a} of the total stocks. Top leaders of the field geographically cover only US (Facebook, Amazon, Apple, Microsoft, and Google) and Asian region (Samsung, Tencent, Taiwan, Semiconductor, Alibaba, Baidu).

Since the start of financial crisis, many Tech companies had shown great returns, which can be demonstrated with their significant earnings, in contrary to the situation on the market of technology some 25-30 years back, when the success of the companies was possible mainly due to optimistic forecasts. Nowadays, in the background of potential economic risks, the market of technology is proven to perform stability and growth. For example, the Top 5 US companies listed above make up around 15{3fbfd6f1e6b19884051837dbbbebf333964dd5fac151615ffbd47b80e5ecc87a} of the S&P 500. The same ratio for Asian countries is even higher. Also, in the current situation, China looks like a new influential player in the nearest future.

Financial Bubbles Of The 60s-70s And Technology Bubble Of The 90s

Bubbles are known by the period of 60s-70s, when a group of 50 companies, which were believed to become global market leaders, dominated the equity market. On a wave of US economic dominance, the valuations of these companies have skyrocketed. A similar situation happened with technology companies in the 90s when their market share has risen five times in a short period. Compared to the bubbles of the past periods, valuation of tech stocks of the biggest IT companies nowadays is much lower. More than that, unlike the times of intense interest in technology in the 90s, a significant part of the current success of IT companies is due to substantial revenues and earnings.

In the 90s the prices were mainly explained with investors’ optimism regarding the potential revenues in the future. By 2000, the Global market share of Technology has experienced a peak, which only happened due to a firm belief of investors in huge potential revenues in the future. The current situation on the market shows that the most powerful technology stocks sell five times better than other market option, and margins for them are double. These factors explain significant returns in the technology sector and make investments in it a very stable and highly cash generative asset.

In this regard, the IT sector nowadays cannot be considered another financial bubble.

References To History

The wave of success of the IT sector on today’s market seems to be the most powerful in the history of humanity. A drastic change of our lifestyle, the rise of new technologies and cloud services led to an explosion of the world’s data generation.

Even when the riot of data seems to go out of control, it profoundly stimulates the rapid creation of new technologies. Similar situations have already happened in history before.

For example, the invention of printing in the 15th century has triggered a rise in the amount of printed information. The further development of technologies over centuries, however, led to the drop in the value of these published data.

In the same manner, the industrial revolution stimulated the extraordinary expansion of railway infrastructure. The total length of railroads in England has increased by more than 600{3fbfd6f1e6b19884051837dbbbebf333964dd5fac151615ffbd47b80e5ecc87a} in the course of 20 years, after that leading to the collapse of the price of new railway companies.

What Does History Tell About The Duration Of Such Periods Of Dominance Of A Particular Sector On The Market?

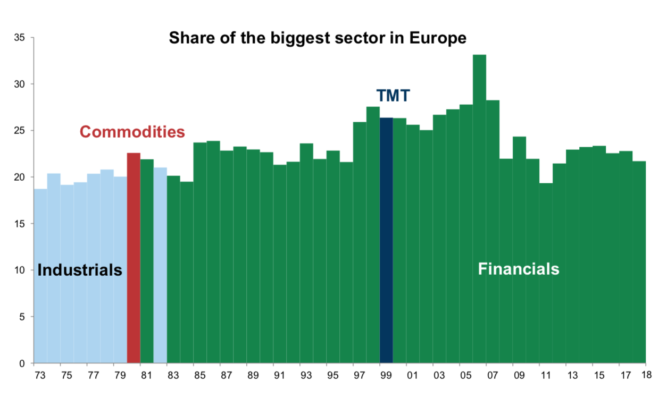

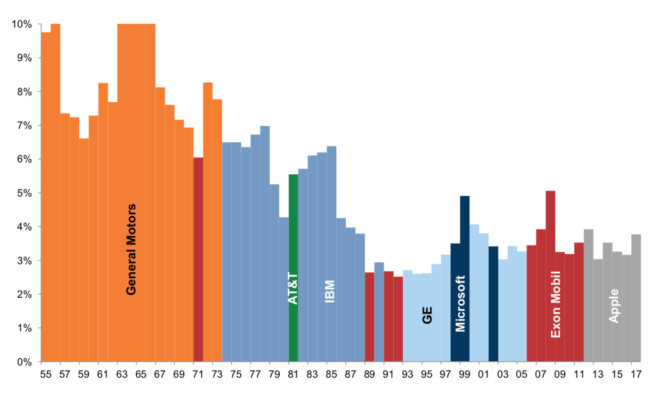

The changes in the modern world happen dynamically, making it hard to predict. History shows that domination of a single sector does not last more than several decades. For instance, Finance and Real Estate market were dominating in the US up to 1850s, giving their positions up to Transport sector, lasting up till 1910s, followed by Energy and Materials, which lost its positions in 80s. Since that time, IT Technology and Communication companies are holding leadership positions. However, one needs to note that the percent of leader’s share is now much lower on the general market – the percentage of IT & Communications sector does not reach ⅓ of the total.

At the same time, in Europe, the sectors dominating on the market had a different structure.

Another interesting fact is that the market is diversifying – the dominant companies in the leading sector have taken a more significant share of the market before, compared to the current giants. For example, the biggest dominating company on the market since 2012 is Apple, and its market capitalization percent is nowhere near the industrial giants of the past.

The Risk of Regulation of the Technology Sector

Discussions on the necessity of control of the IT sector are not new. The recent achievements are linked with the new legislation in data privacy and the rules regarding the digital age. Upcoming laws will start intensive regulation of cookie policy and other aspects of personal privacy, taking terrorist threat into account. The main changes are happening in Europe due to the launch of GDPR regulation law, which unifies data privacy obligations and digital age security in all countries across the EU. These legislation adjustments will as well influence the work of the giants of the market, including Facebook, Google, Skype, and other services. Also, heavy fines have been recently applied to the companies, which were manipulating customer’s opinion in favor of their products. For example, Google was fined with $2.7 bn. for the manipulations on prioritizing its shopping services. Heavy taxes have also been applied to Apple. Nevertheless, history lessons show that regardless of the possible restrictions, the leaders of the market will most probably not lose their positions.

The Future of the Information Technology Sector

Most likely, IT will not lose its positions of a leader in market returns. Experts forecast increased revenues and multiple growths in the field of Cloud services. Also, IT is likely to develop strong links with traditional industries, changing the structure of the economy. For example, the growth of IT companies will stimulate utilizing technology, hence generating returns in traditional industries. At the same time, it is expected to encourage technology innovation, for example, in the sector of artificial intelligence.

Experts suppose that today’s giants of the IT industry will not experience a rapid growth any time soon. However, the overall technology sector will keep on growing, and a throwback to stocks market will not happen in the nearest future.

Recent Comments