When is it Best To Buy Gold? What Factors Define The Price Of Gold On The Market And What Forecasts Are Given By Experts? There is a widespread stereotype that precious metals remain a reliable asset in a portfolio of a modern investor. The market for precious metals highly depends on two factors, which are ‘fear’ and ‘wealth.’ Why are they so important? Let us answer this question by going back to 1999 when the price of gold fell to $250/toz, which was the lowest in the past 20 years. Economists link such decrease of gold prices with the Asia Financial Crisis and gold selling by DM central bank in Europe. In detail, the Asian Financial Crisis has strongly hit the wealth of the citizens of Asian countries, who are traditionally the biggest consumers of gold with the habit of having gold savings and investments. In the time of the Asian Crisis, a significant number of consumers has converted into sellers. At the same time, the decision of banks to launch gold selling campaign happened due to change in their internal policy, because the experts considered gold assets to be old-fashioned. Despite this, the price of gold had quadrupled in the upcoming decades, going back to its cost of the 80s, when demand for gold was explained with the ‘fear’-factor, due to the instability of the US dollar.

How To Use Gold To Diversify Your Portfolio

Lately, the price of gold has been the highest since mid-summer. Expert opinions link it with ‘fear’-related gold demand, which pops up after several months of continuous decrease in gold prices. Gold has already shown better returns than equities, base metals, oil, and even long-term bonds. Experts say that the price of gold is going to keep on increasing in the nearest future. Does it mean, however, that investments in gold are going to give significant returns?

‘Fear’-Driven Gold Prices

The trend of the gold market is that the investment demand for it has become less sensitive to state funds rate and more linked with ‘fear’. One of the reasons that could explain such a tendency is the introduction of ETFs in 2003, after which gold investments have become more institutionalized. Another reason is that after 2008 gold was conceived as a safety bag against systematic risks.

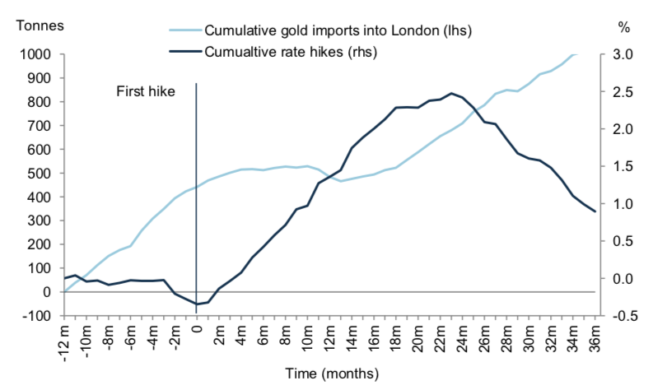

Analyzing the diagrams representing the price of gold in the past three years, one can notice that gold holdings decrease in the middle of the hiking cycle and start increasing back before the end of rate hikes.

Most probably, it is linked with the ‘fear’ of investors, who buy gold as a safety bag before the growth of rates slows down, which also explains the historical increase during the rate hiking cycle, regardless the fact that the returns are relatively low.

Are Investments In Precious Metals A Historical Mistake?

Precious metals have been used as a measurement and store of value for thousands of years. It is hard to believe that this is a historical mistake. Due to their unique physical properties, precious metals have been the most convenient tool for long-term investment, which is also relevant today. After the crisis of 2008, investors have become more conscious about the market of physical goods compared to the market of futures.

Why Are ‘Fear’ Measurement Methods So Poor?

Conventionally, the 10-year cycle has been used to analyze the change of rates based on ‘fear’. However, a 10-year history indicates that during the fed hiking periods, the prices do not represent any correlation with ‘fear.’ Experts explain that when the Fed is hiking, the rates can steel keep on increasing regardless of the high level of ‘fear.’ This tendency is again explained with the nature of gold assets, which are considered to be safety bag. It also suggests that the influence and measurement of ‘fear’ need to be revised.

What Tools To Use To Measure ‘Fear’?

Assessment of recession probability seems to be a more applicable tool to estimate ‘fear.’ Since the unemployment rate is expected to decrease, market ‘fear’ will most probably strengthen its positions. Taking the upcoming political events into account, the worries related with the recession and hence, investments in gold, are expected to increase by summer 2019.

Why Have The Prices For Gold Been So Low This Year?

Gold is considered to be one of the most reliable assets, hence, low price for gold this year is an interesting phenomenon. Gold ETF flows have underperformed due to the temporary removal of speculative positions, which was accompanied by ETF liquidation by hedge funds and banks. Another push has come from central banks, which started buying gold more actively, probably as an attempt to diversify their investments. Thus, such countries as India, Russia, Turkey, Hungary, and Poland have significantly increased their gold assets for the first time in the last 10-20 years. Increasing national gold assets has coincided with certain political frictions in Europe and America. At the same time, the price of gold can be affected by economic and political frictions between China, which is the largest gold market, and the US. This thesis is confirmed with a slight shook of the gold market after President Trump, who was expected to sharpen the tension with China, has been elected.

So What Changes Are Expected On The Gold Market?

Gold remains one of the most attractive investment options. Some factors, such as decreasing unemployment rate and rising inflation can slightly effect on ‘fear’-driven gold demand. Geopolitical tensions may introduce their corrections too, however looking at the history and demand factors an increasing gold price in the next 12-24 months is very realistic.

Recent Comments