Where is Lithium used?

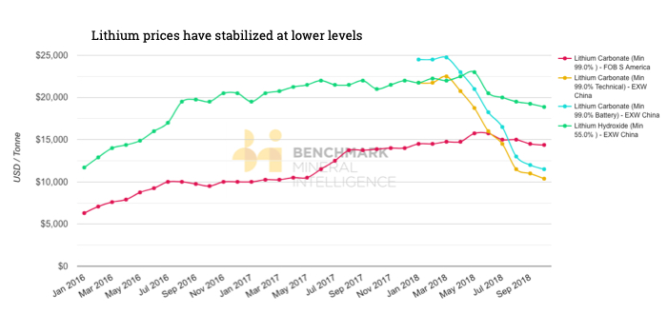

Lithium is one of the few materials used for Lithium-ion battery production. The challenges linked with the supply of this material can influence the whole market of electric vehicles. A boom in electric vehicles has boosted prices for components of Lithium-ion batteries including Lithium and cobalt, as consumers such as car companies to scrambled to secure supplies. The Lithium price reached its peak in summer 2018, doubling in price from just two years ago. The price has been declining gradually since though. We will look into the drivers behind the decline and whether it still makes sense to look at this metal.

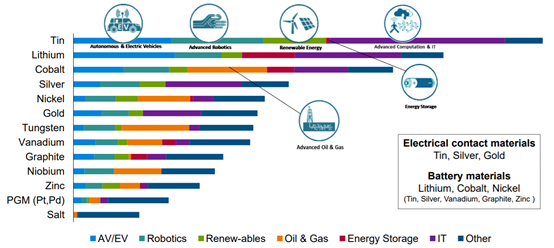

Rio Tinto’s March 2018 presentation ranked Lithium on 2nd place of metals most impacted by new technology, behind Tin and before Cobalt.

Overview of the market

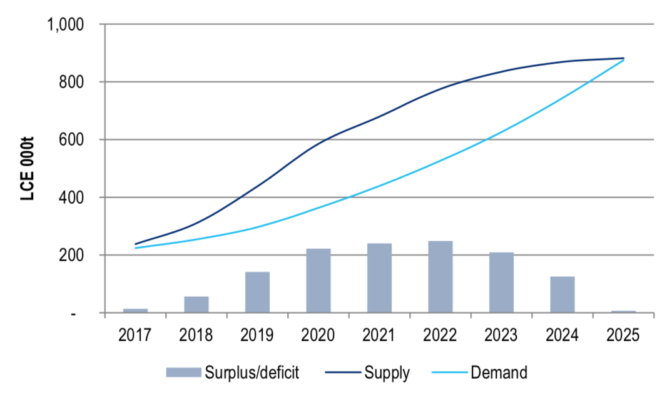

While with the development of technologies, the demand on Lithium is growing, the new wave of Lithium supply is expected to flood the market in the short term.

While low Lithium prices should be a good thing for the Lithium-ion battery industry, some analysts worry that price drops will discourage new investments in production facilities and thus create shortages once demand picks up.

At the moment in China, the biggest consumer of Lithium, the price of the material has almost halved within one year. Such a drop in Lithium prices is good for the production of Lithium based batteries, but at the same time is discouraging for the investors, which may lead to the shortage in this material in the upcoming years.

A tightening in credit forced Lithium market players in China to destock as they tried to secure cash, further flooding the market with the raw material.

At the same time, China removed many of the subsidies for some NEVs as part of efforts to push automakers to focus more on technological improvements instead of relying on fiscal policy.

Within the nearest 3 years, the market is going to be flooded with the 500.000 tons of Lithium coming from the new mines opening in Chile. Morgan Stanley predicted in 2018 for the Lithium prices to fall 45{3fbfd6f1e6b19884051837dbbbebf333964dd5fac151615ffbd47b80e5ecc87a} by 2021, this is roughly another 20-30{3fbfd6f1e6b19884051837dbbbebf333964dd5fac151615ffbd47b80e5ecc87a} from the current price.

Lithium prices have come under pressure in 2018 because miners have ramped up production, consumers de-stocked supplies and subsidies in China’s new energy vehicles (NEV’s) market have been pulled back.

Main players on the market

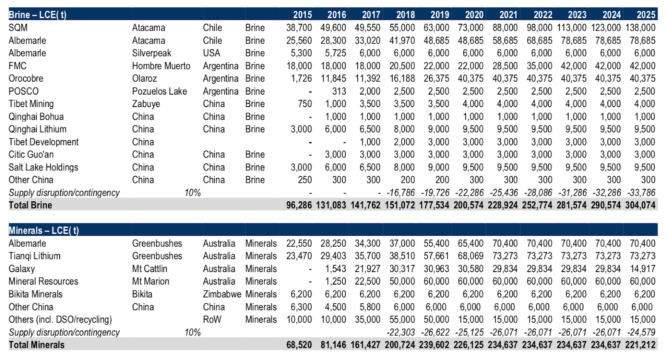

SQM in Chile is by far the biggest player in the Lithium market. Followed by Albemarle and FMC. There are also quite a few Chinese players such as Tianqi and Ganfeng and several junior miners in Canada and Australia including Mineral Resources, LIthium Americas, Orocobre, Galaxy Resources, and Pilbara Minerals.

Lithium Supply Market. Who supplies Lithium?

Recent changes in Lithium supply market are linked with the supply side of the market. Regardless of the fact that car manufacturers are more focused on electro vehicles now, marketing experts are sure that the supply for this metal is not going to fall away any time soon.

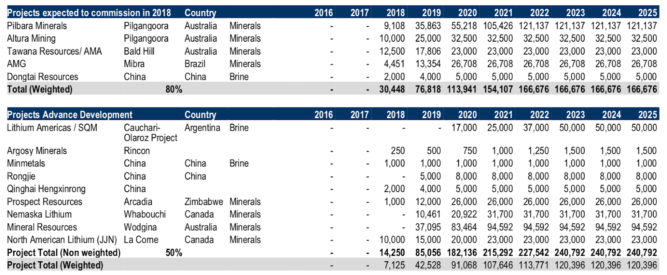

There is a gradual launch of new mines in the coming years achieving significant volumes from 2020 onwards.

Structure of Supply and Demand. Balance curve in the Future

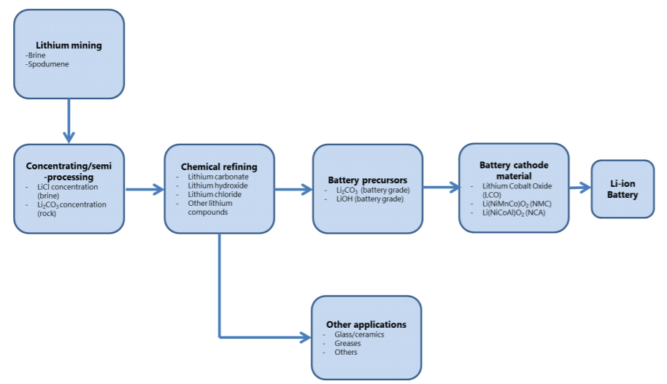

Two sources of Lithium supply that we are going to analyze are Lithium brine and minerals. Lithium production projects are divided into an operating producer, future facilities that are under construction and projects which have to be funded in the future. Two sources of Lithium supply that we are going to analyze are Lithium brine and minerals.

Marketing analysis shows that the earliest date when the Lithium market can return back to balance is 2024 or later.

Possible risks

According to Ganfeng’s Vice Chairman Wang Xiaoshen, there is a potential risk of a Lithium shortage longer term, particularly from around 2023 to 2024, when production of electric vehicles is set to accelerate even further. And that could cause additional problems.

The nature of Lithium supply is indeed changing very fast, and estimation of a long-term price is a challenging endeavor. The risk is that the market is overestimating the potential on the supply side. Of course, there is room for newcomers, but they will likely have lots of problems with production. The investors are scared because they realize this industry still has lots of barriers, even in the upstream. You need the technology, you need of course the market – it’s very challenging for some new entrants to become qualified battery-materials suppliers.

Recent Comments