Why can the Uranium Market be an Excellent Opportunity for Investors? Uranium Market is Under High Pressure of Social Stigma; However, some Experts tell that it can be an Excellent Opportunity for Investors. Learn why is Uranium Worth to be invested in.

The market of Uranium is traditionally linked with a certain negative social opinion. The first verbal associations link Uranium with radioactive contamination resulting from Fukushima and Chernobyl disasters, as well as with nuclear weapons. So what is Uranium – a dangerous substance that may ruin the planet or an attractive investment option?

Where is Uranium used?

Uranium Oxide U3O8 known as yellowcake is traditionally used for producing nuclear fuel. Certain events, such as atomic catastrophes, have a high impact on the price of Uranium ore at the market. The other type of this ore, called highly enriched Uranium, is used for the production of nuclear weapons.

What Determines the Demand for Uranium on the Market?

Demand on Uranium ore is primarily defined by the needs of the nuclear power industry and military plans. The biggest consumers of Uranium ore are the United States, France, Japan, South Korea, India, Russia, and China – the biggest producers of nuclear energy.

Uranium reactors last for 50-60 years. It means that those countries which have launched their reactors a decade or two back are not going to need more fuel any time soon. In this regard, real consumers of Uranium are those countries which are developing their atomic industries at the moment. Thus, currently, China is the biggest consumer on the market at the moment.

Supply of Uranium Ore

Uranium for nuclear power plants is produced from natural Uranium ore, and the most significant number of mines is located in Canada and Kazakhstan. Other smaller mines are scattered mainly across Australia, Africa, and the US.

The Current Situation on the Market. The Main Players.

The biggest producers include Cameco in Canada and Kazatomprom in Kazakhstan. Canadian corporation Cameco and Kazakh Kazatomprom control around half of the global Uranium market. Hence, decisions taken by these two companies define the overall situation on the market. As a proof, one can see that Cameco’s recent decision to shut down one of the largest mines has instantly cut down about 10{3fbfd6f1e6b19884051837dbbbebf333964dd5fac151615ffbd47b80e5ecc87a} of the world’s Uranium ore supply.

At the same time, Kazatomprom has repeatedly cut supply across their mines. These actions taken by the companies who define situation on the market may lead to an increase in the price for Uranium ore.

Other notable producers are Paladin Energy, Energy Fuels and Ur-Energy. On the Exploration & Development front, names to know are NexGen Energy, Uranium Energy Cop, Fission Uranium, UEX, Boss Resources and Berkeley Energia.

Long-term Undersupply on the Global Market

Certain people believe that even shutting the mines down does not lead to rapid changes in the market, because currently, the market of Uranium is oversupplied for the upcoming years. However, if the rates of Uranium mining remain still, the market is falling into significant deficit in the next year already.

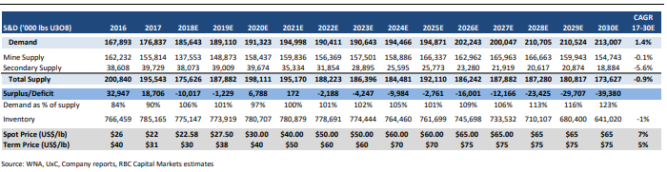

The below table shows how supply vs demand in the Uranium market develops and the long-term price predicted by investment banks, in this particular case, the Royal Bank of Canada.

Uranium for Weapons. Nuclear Catastrophes. Social Stigma

Although nuclear energy is considered to be the cleanest, catastrophes that rarely happen in the atomic industry are very loud and destructive. Another controversial issue is storage or a radioactive waste of the nuclear industry, which has no safe solution at the moment. Thus, the nuclear industry is traditionally linked with discussions on environmental and ethic issues – problems of radioactive waste disposal and discussions behind the very necessity of using nuclear energy.

At the same time, the global consumption of energy is increasing every year, while alternative solutions for energy production turn out to be less efficient. Nuclear power plants cover a very significant part of the world’s demand, and nuclear energy cannot be substituted with other options any time soon due to its low price and efficiency of production.

Even though this field is a subject of social stigma and skepticism, scientists who are well aware of all risks, however, define nuclear power as the least dangerous type of energy. Modernized nuclear reactors which are currently in use are safe and reliable. Nonetheless, rare catastrophes happening in the nuclear field, have a severe impact on the price of Uranium. For example, the Fukushima disaster in 2011 has led to a severe drop in Uranium prices.

Source: https://www.cameco.com/invest/markets/uranium-price

Also, a certain degree of social stigma is linked with the production of nuclear weapons at the base of Uranium. The raw material used in military industry is different though; as for production of nuclear weapons highly enriched ore is used, whereas not so highly enriched Uranium with different characteristics is used as a raw material for nuclear fuel.

Uranium on the Market

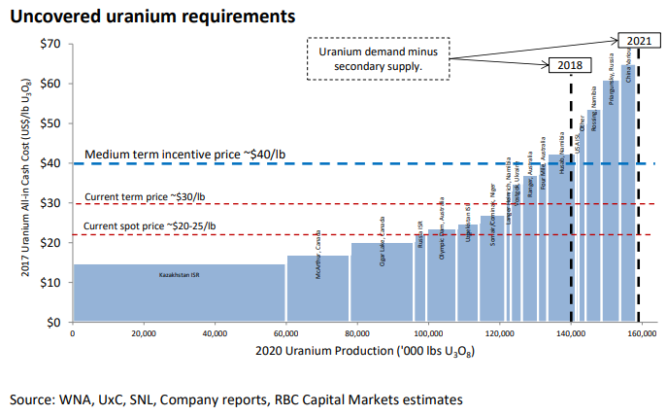

The situation of oversupply has led to a current situation, where Uranium prices are noticeably lower than their marginal cost of production. In detail, currently, Uranium is trading at around $20 a pound, whereas global marginal cash cost is higher as shows in the All-in Cash Cost curve below. Kazakhstan’s deposits are the cheapest to extract and produce, followed by deposits in Canada. Current Uranium prices make it unprofitable for other countries/ players to produce Uranium.

The peculiarity of the Uranium market is in inelasticity of demand and supply curves, which theoretically means that if the market is oversupplied, the commodity may have zero price.

Due to such low rates, the potential buyers become discouraged. Since the time of Fukushima catastrophe, there have been no investments in new Uranium mine construction, which requires 8 to 10 years to reach a production stage.

Since there have been no investments in this field due to such a difficult situation, the price for Uranium ore is probably going to skyrocket after the market experiences deficit in Uranium ore in the nearest 5-7 years. It is practically impossible to cover this deficit quickly, as the supply is limited due to recent decisions to cut production facilities since the launch of new mines requires 8 to 10 years.

The aggressive actions of the two biggest market suppliers we mentioned above make us believe that the market background is being prepared for new prices for Uranium in the upcoming years. In detail, when the market experiences Uranium deficit, in a short time the global cash cost may reach 300{3fbfd6f1e6b19884051837dbbbebf333964dd5fac151615ffbd47b80e5ecc87a} of the current price in a short time, and exceed it.

What can Ruin the Plan? Possible Risks.

1. Catastrophes and Scientific Advancements

The market price is susceptible to any catastrophes that may happen on nuclear power plants – be it due to natural reasons or human factor. Wars or natural disasters, which can hardly be predicted can change the whole industry and the vector of its development. Each catastrophe results into the detailed investigation and measures to prevent it from repeating are taken on all reactors of the same type worldwide. For example, after Chernobyl catastrophe reactors of the same type were shut down or modernized to contemporary security standards, the implementation of which is under the strict control of the world community. Specific changes in the field can be a result of scientific advancements. For example, when thermonuclear synthesis is launched, the world might shift to this type of power plants. However, the problem of thermonuclear synthesis has not been scientifically solved so far, and most probably there is no real solution for it in the nearest decades.

2. New Players in the Field

As mentioned above, there are some countries which are traditionally using nuclear power plants for energy production. However, since there is no need in changing the fuel for 50 or more years, the biggest consumers of Uranium are the countries, where this industry is only on a stage of development. In these terms, China is reported to be an uprising player on Uranium market. Due to its aggressive planning, it’s hard to predict the situation on the market, since China is probably the biggest consumer in the upcoming decades, as it announced the construction of a vast network of new nuclear power plants, which are not calculated in the current equation. While Chinese government declares that the new facilities will be erected within a term of 5 years, we assume that there will be delays in the current plans, and this player will join the market slightly later. However, the intention of China needs to be taken into account in a long-term perspective.

3. Hardly predictable Behavior of Uranium Supply Leaders

Another risk is a rapid change in the strategies of the biggest suppliers of Uranium. The behavior of the leaders on the market might theoretically change. However, the plan for making Uranium deficit on the market seems to be clear, since the inventories are at historically low levels at the moment. Also, launching new supply facilities will take several years, so there is no rapid solution to this problem.

The Future of Uranium Market

All these factors indicate that in the nearest decade the price in the sector will increase by more than 300{3fbfd6f1e6b19884051837dbbbebf333964dd5fac151615ffbd47b80e5ecc87a}. Also, note that before the Fukushima disaster the prices in the field were 700{3fbfd6f1e6b19884051837dbbbebf333964dd5fac151615ffbd47b80e5ecc87a} of the current market prices. The deficit created on the market indicates that a significant rise in prices is inevitable. As a first stage, it is expected that market prices will double in the nearest 2-3 years due to shutting down of Mac Arthur River facilities in Canada.

After this stage, the deficit on the market will keep on growing, and, accompanied by no additional supply on the market, and the prices will rise very high, attracting investors to open new facilities in the future.

Investing in Uranium

The market of Uranium has a fascinating situation, where the value of natural resources is on its historical minimum. Such low prices are also supported by certain social stigma linked with the recent technological disasters and wars.

At the same time, the market of nuclear power is developing very extensively, as there’s no real substitution to atomic energy at the moment – it’s the cleanest, the cheapest and the most efficient sector of energy production, which is recognized by the leading world countries. All of the above indicates that in a run of 2-5 years investments in Uranium will generate a very hefty return.

Recent Comments