Today time is everything. It is a decisive factor for almost all things in our life. You are 1 minute late, and the train is already gone, the plane is on the runway, and no one cares that this can turn your planned vacation or business trip upside down. You are late.

In the business world, things are much more complicated, and if you missed your moment, there would always be someone near who will not miss it and take advantage of the situation. Only the fastest sportsman crosses the finish line, only the most active student gets the grant, and only the most agile businessman makes the desired contract. If you are lagging behind, activists might be on the look-out for you.

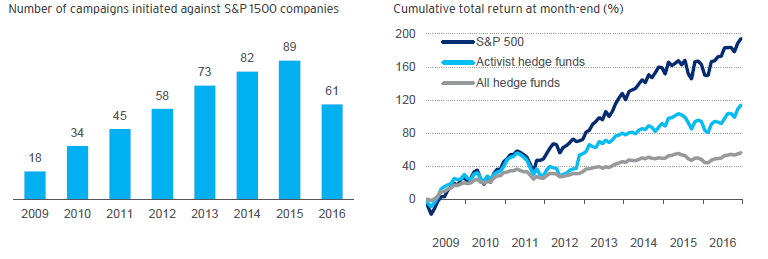

In this review, we will talk about activism in public markets. To date, activist hedge funds are an essential driving force in the boardroom. Even despite the recent decline in campaign activity, in the last four years, activists’ assets under management have doubled. The news of an activists campaign, as a rule, generate an appreciation in the stock price of targets, thereby directly influencing the financial world. Shareholder activism is evolving, and the question of the activist’s presence in the company and its influence on the company’s growth is becoming a live issue.

Conquering the World. Evolving Activism Nowadays.

Activists are gradually but confidently conquering the world focusing their attention on companies with lagging stock returns. In addition to this, increased backing from traditional institutional asset managers and fewer openly confrontational campaigns evidence that shareholder activism has also gained much more mainstream support. The success in board representations acquired by activists, especially at the large targets is indisputable. More and more board seats are occupied with activists as target’s stock returns suggest that such a decision may be a desirable outcome for many shareholders.

Almost half of all activists publicly demand a specific strategic plan with actions aimed at:

- spinning off a division;

- selling assets;

- seeking a buyer for the company.

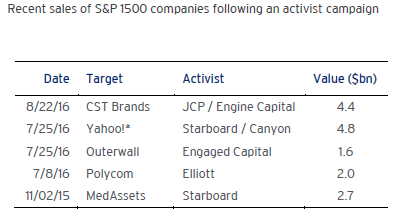

Accomplishing these (and many other) changes by activists investors has been outstandingly efficient – an activist who was asked to seek a buyer for the company was four times more like to be acquired than the average company.

However, not all companies make a public demand for a strategic plan or financial action. Today nearly half of all campaigns are focusing on:

- capital allocation;

- operating efficiency;

- business strategy.

In addition to the listed goals, these companies are aimed at other changes requiring long-term engagement. In many cases, such long-term focus leads to a new board seat for the activist in the company.

What about the numbers? According to statistics, the activity of the activists’ hedge funds was declined in 2016 if compared with the results for 2015 which is considered to be a record-breaking year for the campaign activity. However, most probably this slowdown in activity is temporary as the activists’ funds assets have begun to recover at the end of 2016, and today they are only seven percent below the 2015 peak. More and more new activist funds are launching today, and traditional asset managers are adopting a more assertive style.

Evolution has also touched the shareholder activism. With such changes, companies all over the globe faced with the necessity to reevaluate their vulnerability to activists approach periodically. All of the reevaluations involve careful study of the financial strategy of the company, operating performance, and governance to identify not only actual but also perceived areas of weaknesses. After carrying such a reevaluation, the company should create a strategic plan to fix any weak points before an activist gets the seat in the company.

Evolution has also touched the shareholder activism. With such changes, companies all over the globe faced with the necessity to reevaluate their vulnerability to activists approach periodically. All of the reevaluations involve careful study of the financial strategy of the company, operating performance, and governance to identify not only actual but also perceived areas of weaknesses. After carrying such a reevaluation, the company should create a strategic plan to fix any weak points before an activist gets the seat in the company.

Firms of all sizes have been targeted by activists, although the primary focus was on the smaller targets. Why? They say a bird in the hand is worth two in the bush. Targeting smaller companies is a much lower-risk strategy as they are less likely to require a fund portfolio that is concentrated in a comparably small number of very large positions.

Company Without Activists. Myth or Reality?

The focus of activists’ sector has also shifted. From 2015 to 2016, much more campaigns were aimed at the financial sector targets if compared with the results for the previous years. Companies nowadays are also better prepared to engage with activists and today, a company without activist “on board” seems rather as a myth than a reality. “Think like an activist.” This phrase has become a new mantra of many boardrooms as companies strive to foresee the demands of the potential activist and fix any perceived weaknesses.

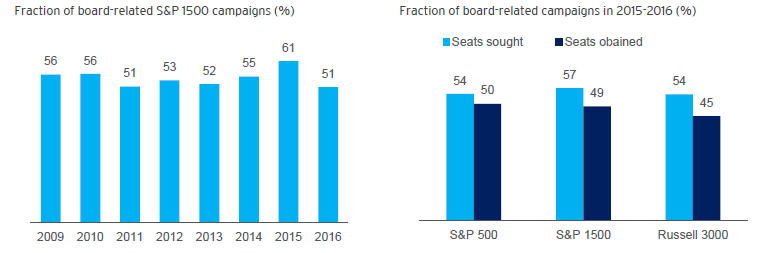

Not all activists interventions go for simply agitating or a particular action, such as increased shareholder distributions or sale. Many of them go beyond it. As a result of this, among all S&P activists campaigns, more than a half have obtained board representation (or sought it) every year since 2009. The peak of such activity was in 2015 and reached the 61{3fbfd6f1e6b19884051837dbbbebf333964dd5fac151615ffbd47b80e5ecc87a} mark. Activists continue obtaining board seats in campaigns, and according to the data for the most recent period, almost 50{3fbfd6f1e6b19884051837dbbbebf333964dd5fac151615ffbd47b80e5ecc87a} of all campaigns have seats occupied with activists.

The success of activists in obtaining the board seats isn’t surprising nowadays- the surprise is that they have got a great success in gaining board representation at the very large targets. To be more precise, activists obtained board representation in 54{3fbfd6f1e6b19884051837dbbbebf333964dd5fac151615ffbd47b80e5ecc87a} of all 2015-2016 campaigns that was a significant increase if compared with the results for 2009-2010, when less than 40{3fbfd6f1e6b19884051837dbbbebf333964dd5fac151615ffbd47b80e5ecc87a} did it.

The success of activists in obtaining the board seats isn’t surprising nowadays- the surprise is that they have got a great success in gaining board representation at the very large targets. To be more precise, activists obtained board representation in 54{3fbfd6f1e6b19884051837dbbbebf333964dd5fac151615ffbd47b80e5ecc87a} of all 2015-2016 campaigns that was a significant increase if compared with the results for 2009-2010, when less than 40{3fbfd6f1e6b19884051837dbbbebf333964dd5fac151615ffbd47b80e5ecc87a} did it.

For today, various companies in different sectors have been targeted by the activist’s intervention. Companies have taken note and decided to be maximally prepared for the activist’s appearance on the horizon. Investment bankers help companies to understand their areas of vulnerability, provide with the regular updates about activists’ tactics and strategies, and advise on preparedness. Altogether, this helps the company to be fully prepared and not to be blindsided when an activist appears.

The next critical question for the companies is “How to engage with an activist?” Dealing with an activist who is aimed at getting the seat on the board is a critical element of any preparation plan. Here, the company has three options to choose from:

- management accommodates the activist’s request for getting the board seat;

- administration resists all the way to a shareholder vote;

- management uses a board seat in a broader negotiation over the activist’s agenda.

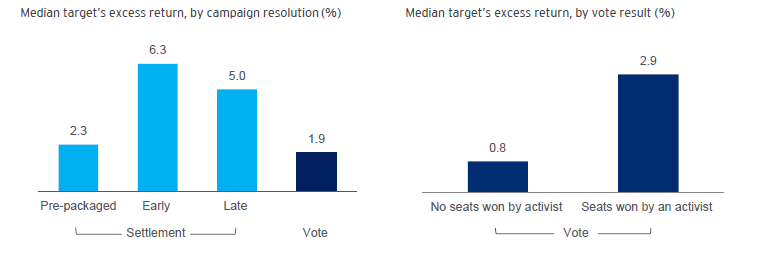

Results of the analysis indicate that sometimes it may be beneficial to set early with an activist. Campaigns that reached an early settlement demonstrated the best outperformance of the stock price between campaign announcement and resolution. At the same time, companies that settled later than 60 days after the campaign announcement showed a lower average return.

So many activists are knocking on the boardroom doors nowadays, and the issue of affiliations and qualifications of incumbent directors has become a decisive element of the corporate preparedness. Finding and especially recruiting high-quality directors takes time. There are even cases when activists nominated their employees as “placeholder” directors until they found a suitable candidate for the long-term director position.

So many activists are knocking on the boardroom doors nowadays, and the issue of affiliations and qualifications of incumbent directors has become a decisive element of the corporate preparedness. Finding and especially recruiting high-quality directors takes time. There are even cases when activists nominated their employees as “placeholder” directors until they found a suitable candidate for the long-term director position.

Conclusions And Highlights.

Having an activist on board doesn’t always mean the instant transformation for the company. It may take time, and there are no guarantees that it will result in changing the company’s goals and course. However, the activist’s presence on board rarely passes unnoticed and in the majority of cases has a significant influence on the development of the company. Summing up everything, let’s highlight the main aspects of the evolving activism landscape:

- activist hedge funds are an essential driving force in the boardroom;

- activism has gained much more mainstream support in recent years;

- companies started to reevaluate their vulnerability to activists approach;

- among all S&P activists campaigns, more than a half have obtained board representation (or sought it) every year since 2009;

- companies without activists on board are rather a myth than reality nowadays;

- activists interventions go beyond simply agitating or a particular action, such as increased shareholder distributions or sale.

Undoubtedly, evolving activism has a positive impact on the companies. Activists are the mighty driving force stimulating the company’s development and growth. Even if sometimes it may be not easy to engage with an activist, in the future it will result in the evolution and benefits for the company. However, it is crucial not only to listen to shareholders but also to ensure they fully understand the firm’s strategic direction and the logic behind the firm’s operating and financial policy. Frequent communicating about the company’s goals, performance metrics, and central business drivers may play a decisive role in the company’s growth.

Undoubtedly, evolving activism has a positive impact on the companies. Activists are the mighty driving force stimulating the company’s development and growth. Even if sometimes it may be not easy to engage with an activist, in the future it will result in the evolution and benefits for the company. However, it is crucial not only to listen to shareholders but also to ensure they fully understand the firm’s strategic direction and the logic behind the firm’s operating and financial policy. Frequent communicating about the company’s goals, performance metrics, and central business drivers may play a decisive role in the company’s growth.

Recent Comments