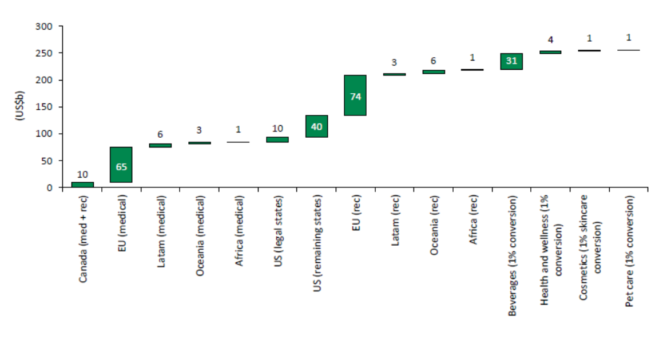

Estimates and predictions about the size of the global cannabis market opportunity vary greatly and continue to increase every day. The numbers range widely from $60-200 billion, and yet experts believe that these estimates are still an undervaluation of the cannabis sector. Experts estimate the most likely value lies in the $230-270 billion range, with the perfect case scenario being as much as $350 billion. Of course, if the global cannabis adult usage rates grow to the same level as those of alcohol and tobacco, then even our suggested thresholds would be considerably exceeded. Experts provide a summary of the baseline global market size scenarios below.

The global base case recreational scenario is estimated to vary within the $110-150 billion. Experts expect about $145 million as the lower end of the opportunity for the recreational market and around $200 billion as the upper end. If you then multiply the range by 75{3fbfd6f1e6b19884051837dbbbebf333964dd5fac151615ffbd47b80e5ecc87a} to reflect the likelihood of 25{3fbfd6f1e6b19884051837dbbbebf333964dd5fac151615ffbd47b80e5ecc87a} of the market remaining illicit, it results in $110–150 billion as a conservative value range of the base-case global recreational market opportunity.

Global medical use of cannabis could add a further $90 billion to our estimates, even though the market is considered to be an under-appreciated segment both in Europe and Canada. Experts estimate the Canadian and US markets to be approximately $1,5 billion and $13 billion, respectively. On the other hand, Europe could represent a $65 billion market opportunity, Latin America – $6,5 billion, Oceania – $2,5 billion and Africa – $0,7 billion. In Asia, Thailand is the only country to legalize medical cannabis, and the market size is valued at $4 billion, although Malaysia and the Philippines may follow suit.

Summing up all the components, the global medical market for cannabis could thus be over $90 billion.

Pre-rolls, edibles, and vapes. Main constituents of the cannabis recreational sector.

The sales of medical cannabis generate higher margins and are less likely to see price erosion, in part due to the direct-to-patient sales model. However, it is still a significantly smaller market when compared to the recreational one, and so experts expect recreational cannabis to dominate the market opportunity. Furthermore, the nature of the black market for cannabis is most likely recreational, as the medical community until recent years was unlikely to prescribe any cannabis to patients. As such, the majority of the modern cannabis black market, estimated at $150 billion, is almost entirely due to recreational cannabis. Among the critical considerations for the conversion of the black market into the legal one are:

- price;

- quality;

- new products (pre-rolls, edibles, vapes);

- ease of access;

- high-quality standards.

As it stands, the legal market is not ready to compete with the black market yet, but experts expect it to make good progress by 2020 and over the next few years.

Edibles are one of the main components of the cannabis sector equation and are expected to bring new users to the recreational market, significantly expanding the opportunities. Decades of government-sponsored anti-smoking campaigns in combination with more health-conscious consumers are currently driving a shift away from tobacco smoking. According to statistics, Canadian smoking rates have dropped to under 15{3fbfd6f1e6b19884051837dbbbebf333964dd5fac151615ffbd47b80e5ecc87a} this year, from a whopping 35{3fbfd6f1e6b19884051837dbbbebf333964dd5fac151615ffbd47b80e5ecc87a} in 1985, and there is no reason for cannabis not to follow this trend as well. The edibles market segment is quite challenging to estimate given the variety of potential options:

- baked goods;

- candies;

- snacks;

- confectionery;

- traditional mainstream foods and beverages.

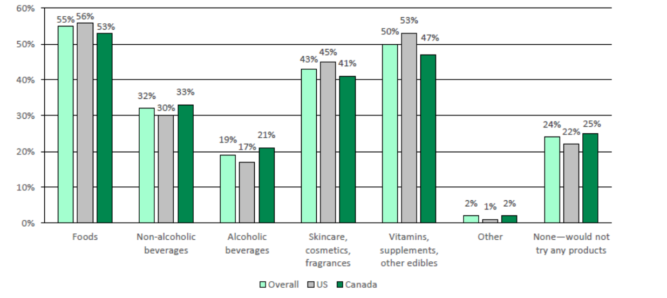

A recent survey showed that 76{3fbfd6f1e6b19884051837dbbbebf333964dd5fac151615ffbd47b80e5ecc87a} of respondents would likely try a legal therapeutic product infused with cannabis. Moreover, the majority chose food (candy, chocolates, baked goods, snacks) as their preferred consumption. Vitamins, skincare/cosmetics, together with non-alcoholic beverages, also ranked high as a preferred product of choice.

It is also essential to keep in mind that cannabis will never be mixed with alcohol by any legitimate company. In addition to this, it is most likely Health Canada will not allow cannabis-infused candies that might look appealing to children, such as gummy bears or lollipops.

Cannabis can also become a threat to multiple beverage segments, given its several noticeable advantages. To date, experts consider alcohol as the segment highest at risk. However, carbonated soft drinks, sports beverages, and energy drinks are no exception. For alcohol beverages, the main risk is that cannabis-infused drinks can offer similar effects, but with fewer calories, less impact on health, and no hangover. Meanwhile, the carbonated soft drinks alongside fruit beverages have been on a steady market volume decline due to their high-calorie contents. It creates the potential for an alternative option such as low-calorie cannabis-infused beverages with health benefits. The same applies to sports beverages, energy drinks, and ready-to-drink coffee. They all may soon find themselves competing against a low-calorie cannabis-infused counterpart, that offers similar benefits such as energy boost and muscle recovery.

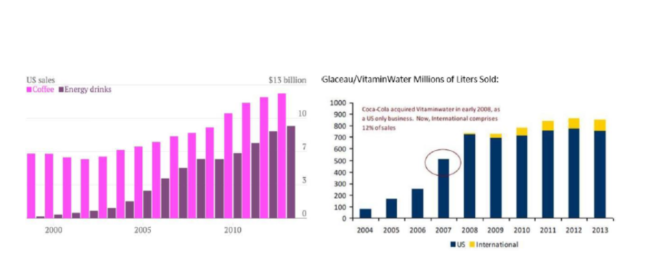

The question is, how quickly can edibles see accelerated sales? Looking back at the explosion of energy drinks from a modest income in 2000 to over $3 billion by 2007 and around $9 billion in 2013, experts can presume that new beverage products can take off with relative speed. Another example is Vitamin water, the sales of which increased from just under $100 million in 2004 to over $700 million in 2008. Based on the growth of these drink categories, experts expect the companies within this segment to get involved with cannabis soon, allowing new beverage products to see accelerated sales early on.

Experts suspect it will take time before the majority of companies can incorporate cannabis into their formulations. The taste remains king, but calories and other critical functional attributes should play a key role as well. Even with limited scientific research due to the previous illegal nature of cannabis, its health and wellness opportunities could be enormous. According to the A.T. Kearney study, ~80{3fbfd6f1e6b19884051837dbbbebf333964dd5fac151615ffbd47b80e5ecc87a} of respondents believe cannabis can offer wellness and therapeutic benefits. This belief is similar across all age demographics, though millennials show a slightly higher level of agreement.

Road to Success. Catalysts and Risks for the Cannabis Industry

In comparison with valuations that do not appear to be a meaningful driver for cannabis-related stocks today, industry catalysts have more of a near-term impact.

- Profits. Companies generating profits faster than others should easily stand out. They should also be more attractive to institutional investors.

- More retailers enter the game. Companies such as Sephora, CVS, Rite Aid, Walgreens, and Couche-Tard are all aimed at selling CBD/cannabis-based products. Further retailer announcements should provide another boost for the sector.

- More CPG players enter the game. Beverage industry “giants” – Coca-Cola and PepsiCo have already started to review the cannabis sector. Also, alcohol industry players as Diageo and Pernod Ricard could get involved soon. Experts also would not be surprised to see other CPG players such as Nestlé or Campbell’s reviewing the sector.

- Edibles provide a noticeable demand boost. Together with the support of such large global players as Constellation, Molson, and InBev, experts expect well-formulated and good-tasting edibles to enter the market. It should drive the demand and margins to continue forward.

- Insurance coverage is improved. More clinical trials and data that prove the medicinal benefits of cannabis should open up broader coverage within the insurance industry. It should also drive more insurance companies to offer cannabis-related coverage.

- Clinical trials provide convincing results. Any data confirming the therapeutic benefits of cannabis would help influence both the medical community and the new users (see the picture below).

As well as every other growing industry, the cannabis sector faces several possible risks on the way to its success and growth. Among the main issues for the industry are:

- Quarterly results continue to fall short. Currently, most LPs have reported a less than stellar profit and sales, creating shareholder frustration and increasing the sector’s volatility.

- Quality-control issues. Complaints of poor quality have started to emerge. If these issues continue to appear, this could impact the demand and keep the black market in a strong position.

- The demand starts to decrease. According to the sales data by Health Canada, Ontario sales have begun to decline month-over-month in January. Most probably, it happened due to limited retail outlets, supply shortages, and poor quality. There is a possibility that demand, especially from new users, will start waning. Some consumers could also be reverting to the black market as a result of the mentioned issues.

- Supply and distribution issues. For the moment, supply appears limited. It is indicated by out-of-stock items both at stores and online. In addition to this, LPs have also experienced lower yields, quality-control issues, crop failures, and other supply chain and logistical problems.

- International markets take longer to develop. The legalization of medical cannabis continues to open up new global markets. However, it may take more time and slow the demand due to either the hesitancy of the doctors to prescribe cannabis or the slow adoption by patients.

- Synthetic cannabinoids. The use of synthetic cannabinoids could lower the costs and drive the prices down.

Conclusions and Highlights

Historically, people have used cannabis for a recreational buzz. Nevertheless, technologies don’t stay still, and to date, the plant is gaining popularity primarily because of its medical benefits.

Among the main drivers of the current growth in the global legal cannabis industry are black market recreational users moving over to the legal market. Also, as more data about its therapeutic benefits becomes available, an increasing number of people begins to use it for medical reasons.

Recent Comments