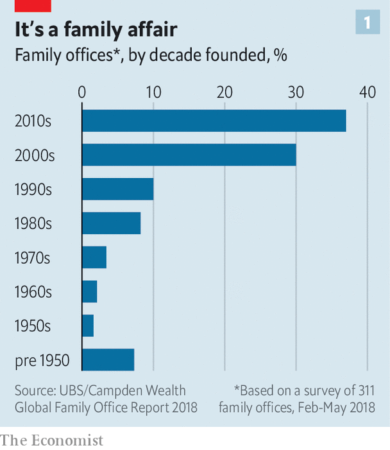

Family offices first appeared in the US in the 1800s to serve America’s wealthiest families, including the Rockefellers and J.P. Morgan. But nowadays family offices are more widespread than ever – virtually every billionaire considers it in bad taste not to have one. The functions of family offices can be extremely varied: from simple tasks like paying bills to managing assets – family offices do it all, and yet, remain a widely overlooked power. Family offices used to be a relatively rare phenomenon, for instance, there are only a few hundred of them that have existed over the past three generations, but the number of family offices in Europe and the US is increasing. Almost 40{3fbfd6f1e6b19884051837dbbbebf333964dd5fac151615ffbd47b80e5ecc87a} of family offices that exist today were founded in the past decade, and there is no sign of slowing down.

Why are family offices becoming more popular?

The reason for such rapid growth in the number of family offices is simple – it correlates with the increase in the number of billionaires and the amount of money they’ve acquired, recent estimates put this figure at around $9 trillion, and family offices manage roughly 30 to 40{3fbfd6f1e6b19884051837dbbbebf333964dd5fac151615ffbd47b80e5ecc87a} of that capital. The number of billionaires and the amount of money they control has been growing due to a widespread increase in business’s liquidity – IPOs play a significant role in this, helping company founders amass large amounts of cash quickly. These new billionaires rapidly want to become actual members of the club, and having a family office is one of the attributes of wealth. Lastly, a large amount of bad publicity around external money managers and investment funds has been steadily turning wealthy people away. Confusing and excessive fees, tight regulations and a bad reputation are causing more and more millionaires and billionaires to turn away from third parties and manage their finances in-house.

What is a family office?

There is no set definition of a family office, all FOs are different from each other in some way, but they can generally be assigned to one of 2 categories: a single family office or a multi-family office. A single family office is what most people think of when they hear about fos. These offices usually serve only one family, employ about ten people and manage at least $100 million.

On the other hand, multi-family offices, manage the wealth of multiple families, as the name suggests. The number of families served by these offices can vary from less than 10 to over 100, although most lie to the smaller side of the spectrum. Multi-family offices allow clans to pool their money to minimize expenses, therefore allowing families with as little as $25 million to participate.

Diversity among family offices

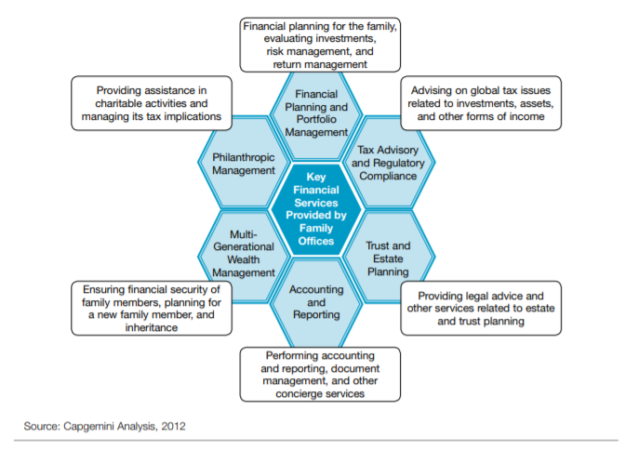

Family offices differ from each other not only by type but also by size and function. Most commonly, a family office manages about 500 million to 1 billion dollars, but there’s no limit to the amount of money a single family office can take on, for instance, one of the largest family offices, George Soros’s oversees about 25 billion dollars. These larger fos usually have hundreds of employees and serve a variety of functions, some of which don’t include finances at all. A family office often manages the clan’s taxes, legal issues, ensures compliance with various regulations and vigilantly monitors the bills to prevent members of the family from being overcharged. The wealthiest families can also take advantage of more personal services, including prenup negotiations, travel arrangement, and divorces, as the goal of staff in the best family offices is to take care of any problem, financial or otherwise, that arises within the family.

Depending on tasks and responsibilities family offices are divided into three categories: an administrative office only takes care of accounting, taxes and general administrative services. Hybrid FOs also provide legal counsel to the family in addition to the functions of an administrative office, often outsourcing simpler tasks to other firms. The most advanced type, fully-integrated family offices help the family invest its capital in addition to all the functions mentioned above. The chart below shows a typical amount of money required for each of these categories of family offices and the average cost of running the office.

| Assets | Assets Overhead Cost / Year | |

|---|---|---|

| Administrative | $50 million – $100 million | $0.1 million – $0.5 million |

| Hybrid | $100 million – $1 billion | $0.5 million – $2 million |

| Fully integrated | > $1 billion | $1 million – $10 million |

What do family offices invest in?

For some wealthy families, the ultimate goal of financial management is preserving the money they already have and keeping it safe from economic turmoils in the world. Others, on the other hand, prefer to shake things up by making often risky but potentially advantageous investments. For instance, Bill Gates’s family office is known for taking advantage of high-risk loan obligations, while many other family offices have recently tapped into controversial and underfunded industries like cryptocurrencies, blockchains, and cannabis. Often family offices can make these investments because they are not limited by strict regulations like most investment funds and banks. In the US, for example, advisers in family offices don’t need to disclose most of the information about their activity to the government. But bitcoins and cannabis startups are not the only things that interest family offices. It is becoming more common for fos to quickly buy large stakes in companies or even buy out entire enterprises. The percentage of private equity in an average family office’s portfolio has become quite significant compared to what it was just a few years ago: the total sum spent on private equity deals rose from 25 billion dollars in 2011 to 100 billion only five years later.

On the other hand, choosing a family office as a buyer often has numerous advantages for the company that’s being sold. For instance, family offices usually make their investments for more extended periods than banks and private equity firms and are more likely to preserve the company’s original culture; this often becomes the deciding factor when the company’s owner chooses a buyer.

While some large family offices that can afford to buy out entire companies do just that, many smaller FOs are investing relatively small amounts of money in new ventures. For example, Conexión Capital prefers to fund new consumer goods in their early stages of development spending about 1 to 10 million per investment. The company also brings other smaller family offices together to invest in new ventures as a group.

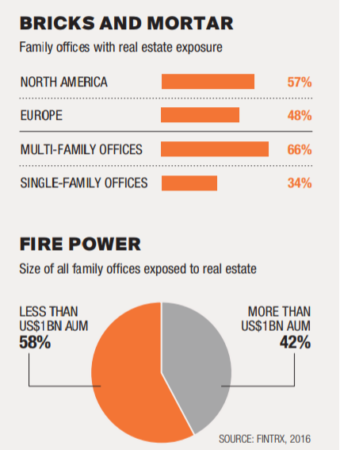

Family offices investing in real estate

In the face of rising taxes and low returns on money invested with hedge funds family offices are also looking for more stable and safe ways to invest their money and real estate has become the go-to investment for many clans. More than half of family offices worldwide were investing in real estate in 2016, and the percentage is steadily increasing every year, with 34 percent of global investment real estate purchased by private entities in 2018. In today’s reality family offices turn to real estate for high, steady returns.

An increase in the amount of wealth invested in real estate is not the only thing news in the world of real estate investment. Investors are becoming savvier with their property, they no longer merely collect the rent checks. Many family offices choose to invest in new types of real estate, such as coworking and office spaces, others invest in residential property in regions preferred by millennials.

In a recent survey of wealth managers, 38 percent of responders said that their clients – high net worth individuals were comfortable taking higher risks with their investments in today’s economic climate, while 32 percent responded that their clients didn’t prefer risky investments but still wanted to pursue high returns on their investments. It is clear that real estate investments with their high liquidity, low risk, and increasing returns have a large market with this second group of investors.

What about traditional investment in hedge funds?

While private equity investments among family offices are on the rise, the percentage of capital that family offices invest in hedge funds has been plummeting, and now it accounts only for about 6 percent of an average family office portfolio. And it’s not just family offices that don’t want to invest in hedge funds. Weighed down by regulations, more and more hedge funds have been returning their clients’ money and converting their funds into family offices, or at least family-and-friends offices that manage the finances of the firm’s partners and employees. This critical shift is also changing the market for the workforce – more and more highly qualified and successful investors and portfolio managers are coming to work for family offices and finding a less stressful work environment due to more relaxed regulations and less publicity associated with the investments.

Arranging succession is one of the biggest challenges of fos

Selecting the right heir to the family’s fortune and ensuring that that heir is well-suited and well-prepared for the task is one of the most significant issues family offices have, and it’s incredibly widespread – two-thirds of family offices are expecting an heir to take over the leading position in the family in the next 15 years. One of the issues that come up relatively often is that the heir doesn’t want anything to do with managing wealth. To prepare the next generation for responsibilities they will eventually inherit many family offices try to diversify their investments to include causes important for the new generation, such as environmental conservation or charitable purposes that still yield financial returns.

Problems and challenges that family offices face

With family offices becoming more commonplace, it’s important to talk about traditional issues that FOs face and new problems that began to arise due to the ever-increasing popularity of family offices. The first of these problems is tightening regulations from the Securities and Exchange Commission, specifically the Dodd-Frank Act. The Act’s purpose is to protect the clients of commercial investment advisers; these advisers will no longer be exempt from the Advisers Act even if they have few clients. However, the Act also defines a family office as a firm that serves members of a family with a common ancestor within the last ten generations. If such family offices are entirely owned by members of the family and the office registers with the SEC, it can continue to be exempt from SEC regulations. The Dodd-Frank act has the highest impact on multi-family offices, family offices that advise clients outside the family and large, old families that don’t share a common ancestor within the last ten generations.

In addition to regulatory issues, family offices traditionally face technological and administrative problems. This includes managing high overhead costs related to staff on payroll and IT, recruiting and retaining highly qualified employees in smaller family offices and maintaining regulatory and tax compliance. The last issue is becoming increasingly more pressing as family offices become more global and start conducting operations in several foreign countries. Complicated legal and tax systems often require FOs to hire outside counsel locally, further increasing operational costs.

Gilded Age of family offices

While some experts are suspicious about the rise of family offices due to relaxed regulations the families exploit to keep their wealth from dissipating, the number of family offices has been steadily growing over the past decades, even expanding to other countries. Asia and its quickly growing number of billionaires are a perfect example of the latest trends among family offices: the number of family offices located in Asia rose from about 50 t0 500 in the past decade with new generation of billionaires being happy to cash out of their companies and have a wealth management firm take over the money. These recent trends are suggesting that family offices have yet to hit the peak of their popularity.

Recent Comments