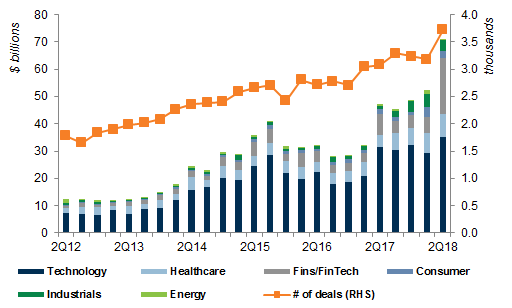

Venture capital (VC) is an asset class where investments are made in early stage and high growth companies. A lot of Venture Capital investments are in Technology focussed companies. This is given the nature of Technology industry being high growth, high return and high risk, however Venture Capital can also be found in other high growth industries such as Consumer, Gaming, Healthcare and many more.

Startups and Venture Capital

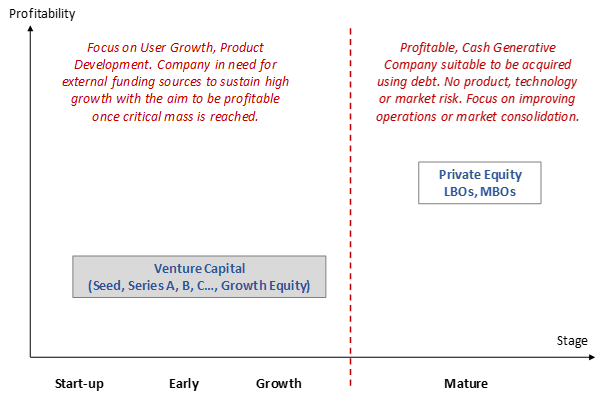

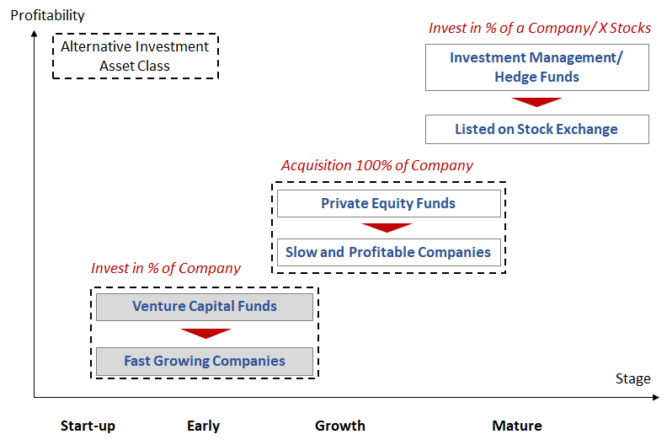

Startups usually look for venture capital investments to increase the scale of their operations, hire staff or get funds to finance the development of their products. Venture capital investments are in a way similar to Private Equity, but while VCs look for new and high growth business concepts, Private Equity funds focus on financially robust businesses where there is no technology, product or market risk. While it is rare to see a portfolio company in a private equity fund going into administration, it is quite common in venture capital. On the other hand, it is also more likely that a company in the Venture Capital portfolio will reach 4-10x returns whereas mature companies in a private equity portfolio rarely exceed 4x returns.

Venture capital investments are typically made gradually, in several rounds. The terminology might be sometimes confusing but usually starts with a Seed round, followed by Series A, B, C and so on. Growth equity is part of Venture Capital given the focus is still to support high growth companies. However given companies receiving funding from Growth Equity funds are usually very late stage or at Pre-IPO stage and the size of Growth Equity funds differs quite a lot to the normal smaller Venture Capital funds, this category is sometimes perceived to be a stand-alone category.

In contrast to private equity, each funding round can have several VC funds backing the same company and investing in a percentage of the company.

How do Venture Capital Funds Operate?

Venture capital funds collect capital from investors (also called Limited Partners “LPs”). These include institutional investors (Sovereign funds, endowments, pension funds, fund of funds etc) and investors such as family offices and High Net Worth Individuals (HNWIs).

Venture capital fund investors have a high-risk high return mandate expecting above average market returns while understanding the risk behind early stage/ high growth companies failing/ running out of cash before there is an exit.

The lifespan of a venture capital fund is similar to a private equity fund, around 5-6 years as an investment period with the total fund life being 10 years (and in most cases ending up being 12 years).

The fund is managed by one or a team of venture capital fund managers. In most cases, the team invests a portion of their own money into the fund (“Skin in the Game”) to show alignment with the fund investors (LPs) and to have an active interest in picking the best companies and delivering a good return.

The primary economic role of venture capital

The entire sector of venture capital exists because it is the first institutional layer of capital backing a new company. The high risk associated with an early stage company is too high for banks to provide debt funding and in most cases even if a bank would be able to provide the funidng, the company would not be able to cover the interest payments expected by the bank.

As for other sources of capital, neither investment banks nor private equity historically could invest in risky companies at the beginning of their existence and public markets are also shut for the early stage companies until they have delivered on a few milestones and showed substantial interest from other investors.

Past and Present of Venture Capital

The history of the modern venture capital industry can be traced back to 1946 when the first venture capital and private equity fund, American Research and Development Corporation, was established. The fund raised 3.5 million dollars from both individual and institutional investors. The slow-growing sector of venture capital was catalyzed in 1958 when the Small Business Investment Act was passed in the US. The Act allowed tax breaks to privately-owned investment companies; as a result, numerous professional investment companies were founded. These companies invested funds into new startups and helped them grow, much like VC funds do today.

In 1959 another change to regulations surrounding investments gave a significant push to the venture capital sector. An amendment to the Prudent Man Rule allowed to judge fiduciary’s investments in whole, taking the entire portfolio into account, instead of evaluating each investment individually, as previously. This new legislation gave investors the opportunity to make riskier investments.

The boom of venture capital investments in the 1960s and 1970s

Following the modification of regulations and legislation governing venture capital, almost 600 new private investment firms were established in just two years from 1960 to 1962. Venture capitalists of the time were focused on investing in early tech companies, in fact, industry giants like Intel, Xerox and others were all funded by venture capital during that period. Venture capital quickly became the primary source of funds for first tech startups.

Another legislation change in 1979, this time to the Employee Retirement Income Security Act, gave a new boost to venture capital. The changes allowed pension funds to allocate up to 10 percent of their assets to risky investments, including venture capital. Due to these contributions of new money to venture capital rose more than 20 times to reach 4 billion dollars by the start of the 1990s.

The Dot Com boom characterized the 1990s. With countless new companies established every year, venture capital firms flourished. Unfortunately, this period of massive growth for venture capital ended with the Dot Com bubble burst that has lead to many companies losing their investments and a lot of Venture Capital firms shutting down.

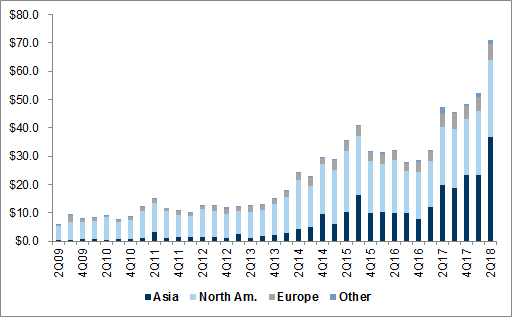

The last few years have been extremely strong for Venture Capital reaching record levels of funding, valuations and number of deals. In terms of geographies dominating the VC game, Europe continues to grow, but the real giants which keep growing are China and US, both reaching similar levels of capital raised last year.

Outperformance of growth vs value and the rise of the FANGs and constant hype about Unicorns dominated the last few years not only the private markets but also public markets. The cycle seemed to reach its peak. However looking at the data the music continues to play with some correction 2nd half of 2018, but a strong recovery in the first weeks of 2019.

There is a line of funding rounds coming up in the Venture Capital world and it will be interesting to see whether valuations will continue to rise.

How Do You Achieve High Returns?

What makes a good venture capital investor? What are the key factors on should look out for when investing in an early stage company?

There are various criteria one should evaluate when looking to invest in an early stage company:

- Strenght of the Team (Founders in particular, but the second level of command also very important)

- Market Size (How big is the addressable market)

- Growth (How good is the Sales growth, recurring vs one-offs, company vs market growth vs peers)

- Defensibility (How high are the barriers to entry)

For a more detailed Scorecard with a detailed list of criteria and weightings, please CLICK here.

Recent Comments