Streaming is a way of delivering sound – including music – without requiring you to download files from the internet.

Streaming Drives a New Era of Music Growth

New technology changes such as the emergence of music streaming and internet radio drive a new age of the music industry. The resulting accessibility, convenience, and personalisation have brought more consumption of legal music and people’s willingness to pay for it. This “second” digital revolution creates more value for rights holders shifting revenue streams from structurally declining markets to a larger new revenue pool.

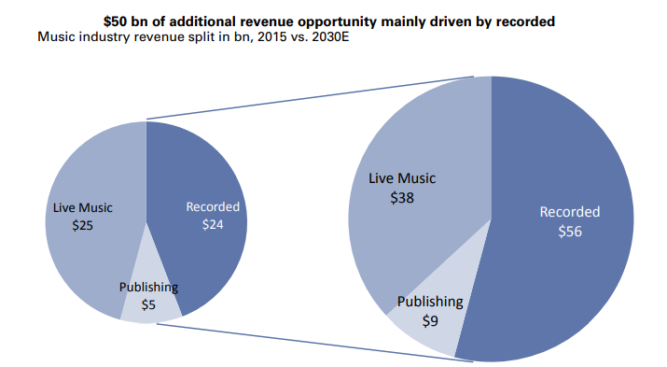

The overall music industry, including recording, publishing and live will double and exceed $100 billion (bn) by 2030.

Streaming improves the monetisation of music content through:

- a variety of subscription streaming options with several price categories which regard consumers, wishing to pay for access and comfort;

- free streaming with an ad addressed to the buyers, who don’t want to spend money on music.

Streaming also enhances the value of music catalogues.

Experts believe industry responses will be critical in shaping the future growth of the music industry which has only started to recover. Some level of coordination among labels and platforms would maximise growth potential. As a result, the split of revenue pools will remain unchanged in the medium term. Experts forecasted the overall music industry (music publishing, live music, and recorded music) revenue to almost increase over the next 15 years to $104 bn from $54 bn in 2015.

Scientists predict that paid streaming services will reach 9{3fbfd6f1e6b19884051837dbbbebf333964dd5fac151615ffbd47b80e5ecc87a} of the global smartphone population in 2030.

The ad-funded, streaming market (including payments from YouTube, Pandora, Spotify, etc.) expects to grow to $7.1bn by 2030. Also, the online innovators (interactive streaming platforms and ad-funded services) will rise to $14bn of net revenue in 2030. Experts say that pure streaming players (Spotify, Deezer, Pandora, etc.) will account for 37{3fbfd6f1e6b19884051837dbbbebf333964dd5fac151615ffbd47b80e5ecc87a} share of net subscriber additions over 2020-30E, Apple Music 26{3fbfd6f1e6b19884051837dbbbebf333964dd5fac151615ffbd47b80e5ecc87a} and other large tech players (Google, Amazon, etc.) 37{3fbfd6f1e6b19884051837dbbbebf333964dd5fac151615ffbd47b80e5ecc87a}.

For the incumbent labels, which receive around 55{3fbfd6f1e6b19884051837dbbbebf333964dd5fac151615ffbd47b80e5ecc87a}-60{3fbfd6f1e6b19884051837dbbbebf333964dd5fac151615ffbd47b80e5ecc87a} of the platform’s revenue as royalties, scientists believe their revenue pool to grow to $35.5bn in 2030 from $15bn today mainly through streaming. Economists also foresee a publisher’s earnings pool to grow to $7bn in 2030 from $4bn in 2015, with streaming alone adding $3bn of revenue.

For the live music segment, streaming could bring a significant opportunity to earn by usage listening data for the marketing and promotion of live events and the possibility to connect directly with fans, therefore increasing artist profit and improving relationships with artists.

Artists and songwriters should benefit from the recovery of the industry through the contract royalties that labels/publishers pay and growth in live music. Recorded music has become a much less essential source of revenue at 16{3fbfd6f1e6b19884051837dbbbebf333964dd5fac151615ffbd47b80e5ecc87a} for the top 40 earning artists compared to touring at 80{3fbfd6f1e6b19884051837dbbbebf333964dd5fac151615ffbd47b80e5ecc87a} (this is not applicable to songwriters). Artists are also reported to make 12{3fbfd6f1e6b19884051837dbbbebf333964dd5fac151615ffbd47b80e5ecc87a} of gross contract royalties compared to 40{3fbfd6f1e6b19884051837dbbbebf333964dd5fac151615ffbd47b80e5ecc87a} of the entire touring revenue. Music creators will gain a stronger bargaining position vs. the labels/publishers, and the platforms as technology and new alternative label/publishers will allow greater transparency and easier access to users. That manifests higher royalty payments from labels/publishers. Labels currently invest around 30{3fbfd6f1e6b19884051837dbbbebf333964dd5fac151615ffbd47b80e5ecc87a}-35{3fbfd6f1e6b19884051837dbbbebf333964dd5fac151615ffbd47b80e5ecc87a} of their revenue in artists & repertoire, and this may grow to 40{3fbfd6f1e6b19884051837dbbbebf333964dd5fac151615ffbd47b80e5ecc87a} or more over time. Experts also forecast publisher’s pay away to songwriters to rise to c.55{3fbfd6f1e6b19884051837dbbbebf333964dd5fac151615ffbd47b80e5ecc87a}-60{3fbfd6f1e6b19884051837dbbbebf333964dd5fac151615ffbd47b80e5ecc87a} over time from 50{3fbfd6f1e6b19884051837dbbbebf333964dd5fac151615ffbd47b80e5ecc87a} today.

Royalty Payments

Royalty payments are the method through which all the participants involved in the production of a song make money, and are incredibly convoluted. The music industry has different copyrights, and so the right to royalties, owned by different players. Songwriters own the rights to the lyrics and melody of a piece of music, and music publishers usually manage these song copyrights. Artists own the rights on a particular song, known as the master recording. These rights are usually assigned to record labels for management.

There are diverse types of royalties paid to rights owners. Royalty payments and the way royalty rates vary significantly depending on the form of the song access.

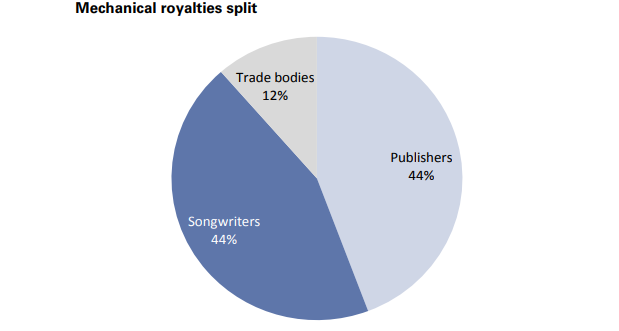

- Mechanical royalties are owed whenever a song is downloading on a digital music site, or streaming through a service such as Spotify. The record label pays the royalties to the publisher (either directly or through a third party organisation). Then the publisher shares 50{3fbfd6f1e6b19884051837dbbbebf333964dd5fac151615ffbd47b80e5ecc87a} of its royalty with the songwriter. In the US, the government sets royalty rates through a compulsory license and calculates it on a penny basis per song for physical/download or based on a formula for interactive streaming services. Online radio and satellite such as Pandora or Sirius do not pay mechanical royalties to publishers. In most countries outside of the US, fees are based on wholesale percentages/consumer prices for physical/digital products respectively and negotiated on an industry-wide basis.

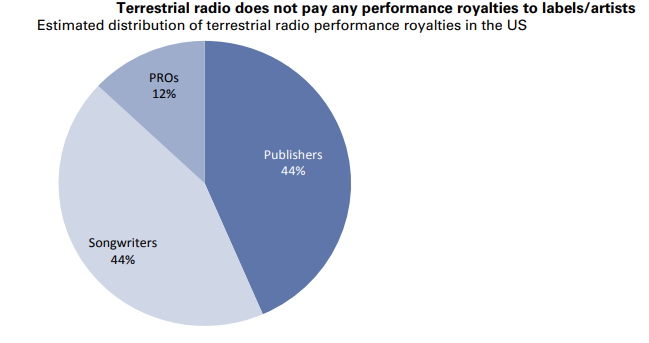

- Performance royalties for publishing/neighboring royalties for recording are owed whenever a singer perform a song (radio/TV/online streaming live venues/ services).

- Songwriters/publishers pay royalties for songwriting performance through the Performance Rights Organizations (PROs) and collection societies;

- The recording artists and labels (either directly or through SoundExchange “SX” in the US) pay royalties to the recording neighboring. In the US, however, artists/labels only get paid for digital performances and not by terrestrial radio as the antiquated US the legislation exempts terrestrial broadcasters from paying royalties for the use of the master recording.

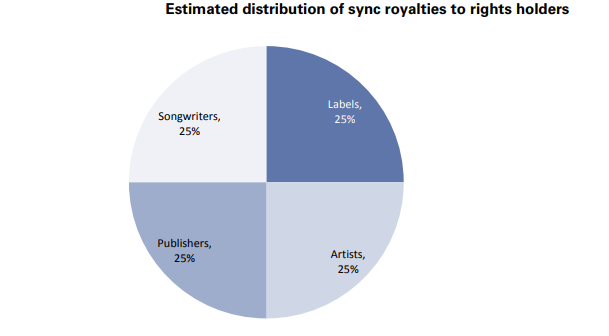

- Songwriters/publishers pay royalties for synchronisation and record labels/artists for a song used as the background music for a movie, TV program or commercial, video game. There is no visible rate defining the compulsory percentage of royalty to spend. It can turn on the commercial value of the work to those who want it, and the media to use. Sync royalties are usually equally split between labels, artists, publishers, and songwriters.

Contrary to the US, in Europe, it is more of a free market, but it does vary from country to country. In some countries, there are tribunals, arbitration bodies, not as powerful, that set the rates. The UK is probably the closest structure to the US. In most of continental Europe, the collecting societies often have some degree of royalty rates review by some form of a government agency with various degrees of severity and independence.

Economically, streaming pays a percentage of revenues versus a per unit royalty as is the case with physical and digital sales. It needs to look at the overall business model to understand the influence of streaming on royalty rates. For example, Spotify keeps 30{3fbfd6f1e6b19884051837dbbbebf333964dd5fac151615ffbd47b80e5ecc87a} and pays 70{3fbfd6f1e6b19884051837dbbbebf333964dd5fac151615ffbd47b80e5ecc87a} to rights owners, of the 100{3fbfd6f1e6b19884051837dbbbebf333964dd5fac151615ffbd47b80e5ecc87a} revenue. These 70{3fbfd6f1e6b19884051837dbbbebf333964dd5fac151615ffbd47b80e5ecc87a}, publishers and labels have to split among them. Labels generally take a higher percentage of that pie than publishers, as is the case with physical and digital sales. Regarding impact, there is a constant fight for publishers to receive more money and the labels want to maintain their larger share. One should take a step back and think about the right split and value proposition of each party.

Streaming Benefits From a Growing Audience

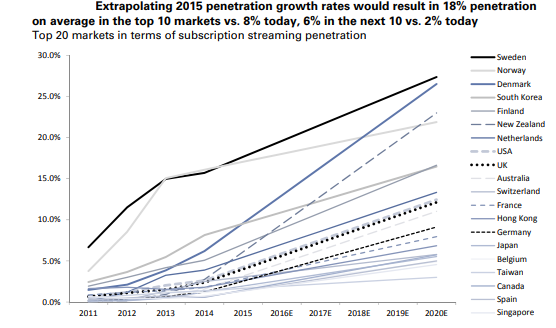

- Growing penetration of paid subscription services. There are different ways to improve the penetration rate (currently at 3{3fbfd6f1e6b19884051837dbbbebf333964dd5fac151615ffbd47b80e5ecc87a} on average) and catch up with the most advanced markets which are already over 20{3fbfd6f1e6b19884051837dbbbebf333964dd5fac151615ffbd47b80e5ecc87a}. Paid streaming penetration growth has been accelerating.

- The market influence on streaming. The emerging economies represent one of the most significant opportunities for the streaming industry. New business models (ad-funded, telecom bundles, prepaid, etc.) and payment capabilities have been appearing. Market’s under-representation is the result of widespread counterfeiting and piracy and under-developed physical retail infrastructure. Alliance estimates music piracy rates are more than 90{3fbfd6f1e6b19884051837dbbbebf333964dd5fac151615ffbd47b80e5ecc87a} in China, Mexico, Brazil, and India.

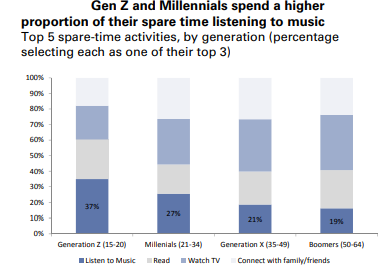

- Gen Z and Millennials are the ideal audiences for streaming. The changing media consumption habits of Generation Z and Millennials are particularly beneficial to the music industry as a greater share of their spare time is being spent on music than on reading and TV. Millennials already spend a higher absolute amount of money on music which is mainly attributable to live music and paid streaming.

- Telecom and tech companies use music content. Mobile carriers are now increasingly seeking out streaming music and video services as a means of driving upgrading and upselling opportunities as well as differentiation. Telecom operators’ large marketing budgets and sizeable existing billing relationships make them ideal partners to enter a new market at little cost, and reach younger demographics. Along large tech companies have also made a significant invasion into music streaming over the last three years as a way to better lock users into their ecosystem and sell more advertising (Google), products (Amazon) and devices (Apple).

As we see from the article, the impact of streaming on the music industry is very high. Streaming has created a more democratic music industry. Artists can make money with or without a label, and the spending power of a genre’s audience doesn’t affect how much money they can earn. Thanks to streaming platforms –people were taken out of the dark times.

Highlights:

- Streaming drives a new era of music growth

- Streaming disintermediates the industry and increases the economic portion allocated to artists

- Various types of royalty payments and structures make the understanding of fairness still complex to understand;

- Streaming benefits from the era of digitalisation and mobile only and enjoys a growing audience.

Recent Comments