What is Private Equity?

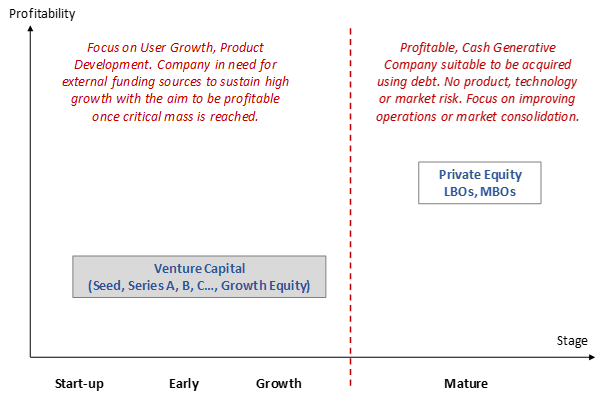

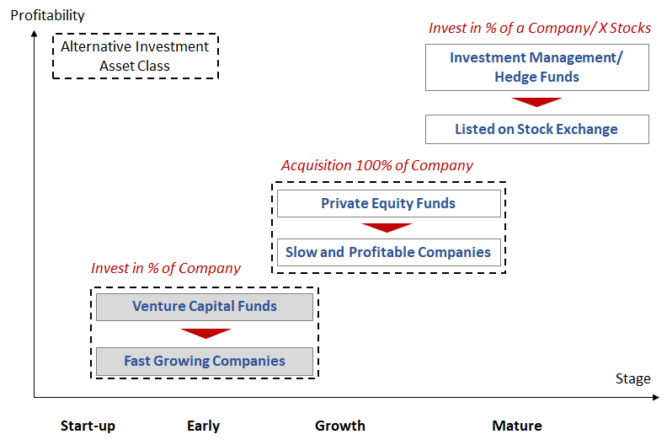

Private equity (in short “PE”) is a certain amount of “at-risk” capital that’s invested privately, as opposed to buying shares on the public market.Private Equity investments are usually in connection with management buyouts and management buy-ins in mature companies, as opposed to venture capital which provides funding for early stage companies. The chart below gives a summary how the different forms of private capital investing compare against each other in respect to the level of maturity.

In Private Equity most of the company is being purchased (in most cases) as opposed to some shares in the case of public markets investing or minority ownership in the case of venture capital.

What is a Private Equity Fund?

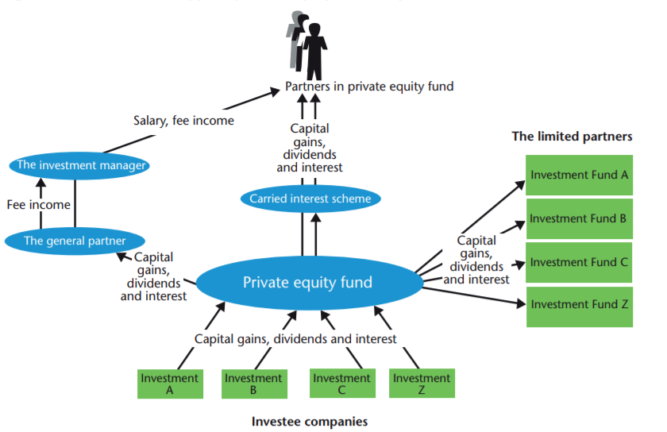

A private equity fund is a form of “investment club” consisting of investors (also called Limited Partners (LPs). These investors (LPs) commit a certain amount of capital for a fixed number of years (usually 10 years) for a mandate (e.g. mid-cap companies in Germany in the Industrials space). The investors can be split into institutional level investors such as pension funds, endowment funds, sovereign wealth funds, insurance companies, banks, fund of funds, as well as smaller investors such as family offices and High Net Worth Individuals (HNWIs). This group of investors invest in a private equity fund with the objective to receive above average market returns by relying on the managers in the private equity fund to identify and research private companies, acquire them, improve them operationally and sell them after several years (usually 3-5 years, but can also be longer) for a higher price to somebody else. A private equity fund has usually an investment period of 5-6 years and a fund life of 10 years, although an option to extend the lifetime by 2 years before all the money (initial plus additional returns) must be returned to investors is quite common.

Key Theories Backing Up the Private Equity Investment Model

Inefficient Markets

While many could argue that public markets are quite efficient and thus achieving 15{3fbfd6f1e6b19884051837dbbbebf333964dd5fac151615ffbd47b80e5ecc87a}-20{3fbfd6f1e6b19884051837dbbbebf333964dd5fac151615ffbd47b80e5ecc87a} annual returns on a consistent basis is very difficult, it is easier to see how this could work in private markets.

Private markets i.e. privately-owned companies report only a fraction of the information public companies must report, thus the market is much less transparent, and data is much harder to obtain.

Pricing and valuation of companies is also much more difficult in private markets; thus, inefficiencies can arise, and mispriced opportunities can be taken advantage of.

The Principal-Agent Problem

A widely accepted theory states that most companies have a principal-agent problem, that is, the principals – the people who own shares of the company – don’t manage the company themselves, instead, they hire managers – the agents. In the majority of cases the managers (agents) do not have any ownership in the company and compensation is not correctly aligned, thus their actions conflict with the interest of the principal in many cases. They are not motivated to give the shareholders the most substantial returns on their investment.

Private Equity ownership usually comes with a much better principal-agent alignment with specific pay-outs and rewards when certain milestones are achieved, this can be in form of giving the agents a percentage in the company, bonuses linked to the performance of the company or both. This alignment of interests increases economic efficiency and returns.

Operational leverage (Value Add)

In many cases, the ability to get quick financing and implement big changes if you are privately owned is very challenging (although that can also apply if the company is publicly listed). Private Equity funds make use of a playbook where they know exactly what points can be triggered to quickly improve the company. Examples include enhancing the leadership of the company, making the reporting lines in the company leaner, improving the handling of working capital by introducing better systems to deal with suppliers and customers, and many more.

As with all investments, private equity funds are interested in the success of the companies they invested. PE funds can achieve this by several mechanisms, including putting fund’s representatives on the board of the company as directors and as observers, setting limits on what management of the company can do without the fund’s approval, establishing incentives and penalties for successes and failures of the company.

By having interests aligned between the owners (private equity fund) and the management team, longer term goals can be perceived, and value of the company can be maximised. This is in contrast to some of the difficulties in the public markets where shareholders might only be interested in short-term financial gains and thus the company is constantly fighting a battle between short-term and long-term value creation.

Financial leverage (debt)

Most private equity funds use not only their committed capital (the capital investors gave them for the defined period of time as described above), but also debt they obtain from a bank when they want to purchase an identified company. The use of debt alongside the equity, increases the returns achieved by private equity funds on their committed capital given they use less of their own capital to purchase the company while the interest and amortisation of the debt is being paid down the portfolio company.

Having a debt burden as a company amplifies the need to perform, discipline and hard work by the management team as the risk for financial distress is higher.

For these reasons, the use of financial leverage can significantly increase investment returns; thus, it is beneficial and desirable for both investors and fund managers. On the other hand, geared investments carry a much higher risk of bankruptcy for investors than investments made without borrowed funds. Financial analysis and modelling out various downside case scenarios of the business plan is critical before taking on debt and financial discipline when running the company is of utmost importance.

Patience and Cycles

There are several other reasons why private equity delivers above average returns and it is not the purpose of this article to provide a complete set of reasons, however being able to sit out cycles by buying a company when it trades at low valuations (““low multiple”) and selling it at a much higher price purely because the investment sentiment recovered and the whole market trades at higher valuations, is a big driver behind the returns of private equity funds.

What Do Private Equity Fund Managers Do?

Private equity managers usually complete a variety of tasks. These include:

- Origination (sourcing investment opportunities off market and via intermediaries and investment banks)

- Analysis (initial research and analysis, due diligence process)

- Execution (structuring, negotiating, completing the investment)

- Active Management (implement value add plan, co-ordinate advisors, regular reporting and review of performance)

- Exit (determination of most value creating path to monetisation, management of sale process)

- Fundraising (dialogue with existing and potential new investors for next fund)

Economics of the Fund

Fund managers (General Partners, in short “GPs”) receive management fees which are a percentage of the funds raised (Assets under Management “AuM”). Bigger funds have a larger amount of fees paid to them in absolute terms. Industry practice is around 2{3fbfd6f1e6b19884051837dbbbebf333964dd5fac151615ffbd47b80e5ecc87a} with smaller funds or first-time funds being at 1.5{3fbfd6f1e6b19884051837dbbbebf333964dd5fac151615ffbd47b80e5ecc87a}.

The management fee is intended to cover salaries, office rent, travel, compliance and any other operating costs associated with running a fund.

Alignment of interests between investors in the fund (LPs) and the private equity firm (GP) is made using the concept of “Carried Interest” or in short “Carry”. If the investment strategy achieves a return (sometimes that includes being above a previously agreed minimum threshold e.g. 8{3fbfd6f1e6b19884051837dbbbebf333964dd5fac151615ffbd47b80e5ecc87a}), the fund managers will receive a preferential share of the return. The industry standard for this preferential share is around 20{3fbfd6f1e6b19884051837dbbbebf333964dd5fac151615ffbd47b80e5ecc87a}.

Structure of a Typical Private Equity Fund

Past to Present in Private Equity

The history of private equity investments as we know them began in the 1980s. In the 1960s “asset stripping” – a process when a failing company with valuable assets was bought, its assets were sold off, and employees fired – became very widespread. This scheme prompted many countries to make the practice illegal by prohibiting companies from borrowing money and giving security on assets owned by the enterprise that was going to be acquired with that money. The legislation was later modified to allow for the legitimate rescue of companies, leading to the first boom of private equity buyouts by banks and their subsidiaries in the 1980s in Britain and America. These investments generally backed company management and didn’t participate in managing bought companies. In the US the market proliferated fuelled by large returns that drew more investors to private equity. In Britain, on the other hand, funds remained relatively small with average large buyouts substantially smaller than in the US.

After the recession at the start of the 1990s, many private equity funds that borrowed money for investments found themselves on the brink of bankruptcy as their investments failed. This lead to a decrease in the number of PE funds and investments, insolvent funds became subject to buyouts themselves. The economic reality lead private equity funds searching for ways to improve their investment success rate and to differentiate their investment focus. Some funds did this by specializing in one sector or one country. Others became more known for how they generate value, buy and build vs operational turnaround vs financial engineering. By the end of the 1990s, the largest companies in the business became increasingly more global, aiming to invest internationally.

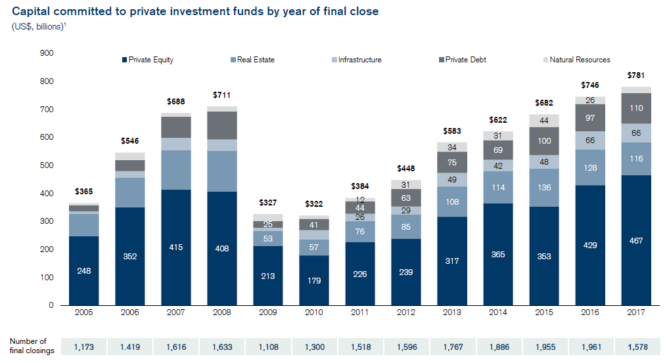

From 2005 to 2007 the private equity market experienced a new boom due to steady economic growth after the recession of the 1990s and low inflation. During that time banks began selling the loans they gave out to other financial institutions, leading to new financial instruments appearing and innovating the debt sector. All of this resulted in a growth of size and number of PE funds, more massive gearing, and more prominent deals that lead to higher returns.

In 2007 the debt market was poorly regulated, complicated and misunderstood by the vast majority of professionals. Banks were giving out loans, selling that debt and using the money to fund new investments, and when more people than expected were failing to pay their mortgages, the situation got too complicated to understand who would be left responsible for those debts. Banks stopped giving out new loans and selling debt, so those banks that needed to be refinanced went bankrupt starting with smaller financial institutions all the way up to the largest banks. Since banks were no longer lending money, PE funds were struggling to raise debt to acquire companies and struggled to refinance their existing debt obligations. As a result, the general number and volume of PE deals dropped during the financial crisis.

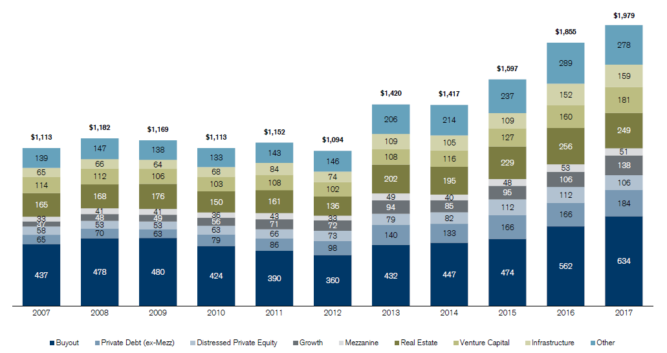

In the years following the recession, a big boom in alternative investment strategies happened, and in particular private equity fundraising volumes surged to levels above pre-crisis levels in 2007.

In theory private equity funds try to avoid competitive, public buyouts since competition drives up the price of the deal, making it less lucrative, however in reality there is so much dry powder available which needs to be deployed, that auctions are still very common and private equity funds running the risk of overpaying.

Recent Comments