What is the Current State of Manufacturing?

Today manufacturing composes 16 {3fbfd6f1e6b19884051837dbbbebf333964dd5fac151615ffbd47b80e5ecc87a} of the world’s GDP. It is an essential fact of an economy’s productivity growth and some instances, the most significant component of an economy’s foreign trade. Many factories are operating in an environment which is “disconnected” i.e. the critical causes of inefficiencies are rarely fully understood. Automation and connectivity could offer a solution to this.

When thinking about the future of factories, the three areas where the current state of manufacturing is behind or even lacking are the follows:

- Machine-to-machine communication

- Two-way data transfer

- Inter-factory integration

Automation can be achieved easier if there are few different products but each of these products are produced in high quantity. Major automakers and some other firms have already created production systems that respond to these challenges, regarding volume and product mix. However, smaller companies and industries with end products have yet to embed such systems into use. The emergence of new technologies forecasts an era of significant change in manufacturing.

The factory automation requires traditional manufacturers to cut costs while increasing productivity, to remain competitive with aggressive, lower-cost manufacturers entering their industries. Since the financial crisis, returns have stagnated, as fixed costs have continued to rise. Experts believe that manufacturing will implement new technologies and there are several reasons for it:

- Developed markets need to cut costs to stay competitive vs. Emerging Markets

- Special workforce becomes more deficient

- Productivity becomes a way to differentiate when everybody produces at high capacity

- There is an increased push to reduce time to market

- Clients demand unprecedented customisation

- Attention to security and safety has grown dramatically

- Several governments are actively pushing to stay ahead in manufacturing

- Short-term when everybody produces at high capacity

- Key technologies now exist available and ready for connected manufacturing

What are the Six Innovative Technologies for Factories of the Future?

The factory develops and enters an era of new technological innovation. “Industry will impact the whole product lifecycle end to end – from design to production.” Experts forecast the entire production process to become more intelligent, from design to services:

- Intelligent design: Factories and products will be designed intelligently using the newest software for modeling and simulation optimised to decrease the time of stagnation and the process of construction. The design phase can affect up to 70{3fbfd6f1e6b19884051837dbbbebf333964dd5fac151615ffbd47b80e5ecc87a} of the costs of a new product.

- Intelligent administration: A remotely managed factory allows control of factories that located in low-cost areas, while works from the corporate Head Quarters.

- Intelligent production: Smart factories improve operational performance through higher productivity and reduced costs. The process is continuously being optimised using automation equipment and data collection. Cloud and Edge factories might emerge, giving manufacturers, particularly new entrants, to focus on design and sales, rather than massive factory investment.

- Intelligent product: Big data of users’ experiences helps make product design adjustment/upgrades easier, as well as increasing products customisation. Data also support generation after-sales.

- Intelligent sales: Optimised sales/advertising channels based on buyers’ prior purchases.

- Intelligent after-sales: Predictive handling, resulting in more stable cash flow generation and avoiding unnecessary downtime for the customer, as well as useless, costly after-sales personnel.

These six technologies can be clustered into three areas:

- Manufacturing design and production simulation;

- Physical manufacturing;

- In-factory logistics.

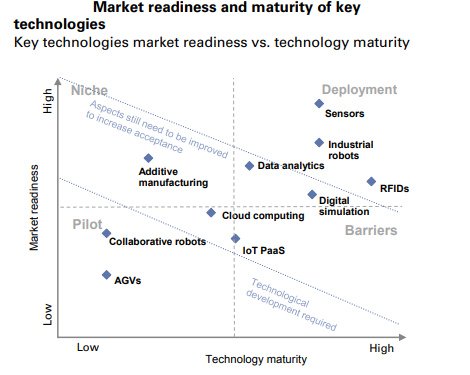

The following factors are taking into account when speaking about these six technologies:

- The current state of the installed data with such techniques;

- The level of existing penetration of the disruptive technology;

- The evolution of the penetration rates of these technologies over the next five years.

Technologies adopt at variable rates, and entirely unexpected applications can arise to dominate their uses. Many of these emerging technologies will be used in conjunction with each other, potentially multiplying their impact.

What is the Future of Manufacturing Ecosystem for each Industry?

Experts see the most excellent opportunity from a shift to best-in-class manufacturing for:

- Electronics – Up to US$120 bn

- Machinery – Up to US$110 bn

- Food & Beverages – Up to US$100 bn

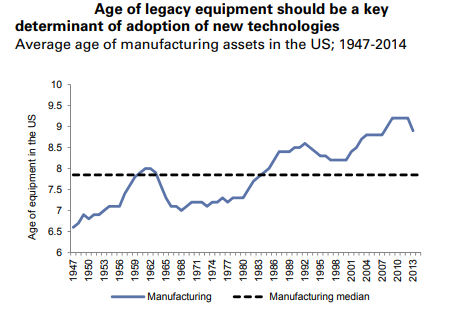

The future of the manufacturing ecosystem will differ markedly for each industry. Impact factors include:

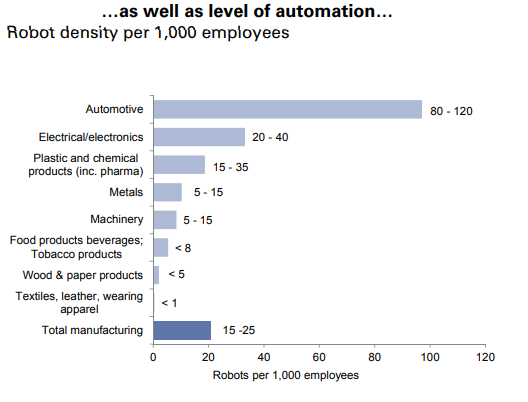

- The current level of automation

- The market pressures industries are facing

- The products nature that they produce

- Other factors such as labour intensity and asset age

Companies can use different complexity levels depending on the goods that they produce and where the cost makes up the critical factor.

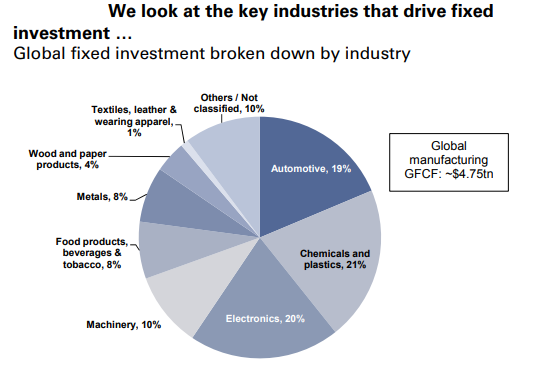

Automotive

Around 19{3fbfd6f1e6b19884051837dbbbebf333964dd5fac151615ffbd47b80e5ecc87a} of global manufacturing fixed asset investment goes into the automotive industry, worth around US$900 bn. Regional access points are the US, Japan, Germany, and China. The automotive industry has industrial automation from the early 1970s: it is the largest market for industrial robots, accounting for 43{3fbfd6f1e6b19884051837dbbbebf333964dd5fac151615ffbd47b80e5ecc87a} of global robotics sales in 2014. When deciding where to manufacture products, the automotive industry is still influenced by tariffs, which are present in all major manufacturing locations. The two leading technologies for this industry given the current levels of penetration increased usage of automatically guided vehicles and the introduction of collaborative robots.

Electronics

About 20{3fbfd6f1e6b19884051837dbbbebf333964dd5fac151615ffbd47b80e5ecc87a} of global production fixed asset investment is into the electronics industry; worth over US$950 bn. Electronics has the most significant possibilities despite its high level of automation. The maximum cost savings to the industry could equate to a total addressable market (TAM) of around US$120 bn. Electronics has powerful customers. As a result, the absolute volume size remains essential, and the industry is one of the early adopters of new technologies. While all FoF technologies have a crucial relevance in electronics, experts believe the real manufacturing technologies and in-factory logistics have the highest potential.

Machinery

The industry is similar to the mentioned above, but competition differs with quality and innovation. Machinery also consists of highly traded goods, where manufacturers have access to global markets. However, volumes are substantially lower than in electronics and auto. As costs come down and capabilities improve, it expects much higher adoption rates. Experts see the most potential for the three industries with the lowest current penetration: IoT PaaS, cobots and AGVs.

Food products, beverages & tobacco

At 8{3fbfd6f1e6b19884051837dbbbebf333964dd5fac151615ffbd47b80e5ecc87a} of global production investment goods is into the food products, beverages & tobacco industry, worth US$350-400 bn. Food products, beverages & tobacco manufacture in places that simultaneously improve closeness to raw materials and end customers. Food manufacturing typically is in the condition of a low trade, although some products such as powdered milk and frozen seafood go on export. The FoF technologies IoT PaaS, AGVs, and PLM software offer the most excellent opportunity.

Metals

Around 8{3fbfd6f1e6b19884051837dbbbebf333964dd5fac151615ffbd47b80e5ecc87a} of global manufacturing fixed asset investment is into the metals industry, worth more than US$350 bn. Metals plants are resource- and energy-intensive. Their products are heavy, so the most critical factors for success in those areas include easy access to raw materials, low-cost energy, and cheap transportation. PLM software is the most relevant for this field, but there is also significant potential for AGVs and IoT PaaS.

Chemicals and Plastics

Near 21{3fbfd6f1e6b19884051837dbbbebf333964dd5fac151615ffbd47b80e5ecc87a} of world manufacturing fixed asset investment goes into the chemical and plastics industries, worth US$950 bn-US$1 tn. Chemicals involve bulky, commodity-type products with low trade intensity, but also R&D-intensive pharmaceuticals and cosmetics that have high-value density and trade. The variety of products within this industry requires diverse production environments, and the size of the opportunity for capital goods providers will vary. Chemicals are the largest manufacturing industry regarding fixed asset investment, and given its size, it is a massive market for equipment suppliers. It expects PLM software to be an increasingly important technology for the industry as well as increased adoption of IoT PaaS software.

Wood & paper products

Around 4{3fbfd6f1e6b19884051837dbbbebf333964dd5fac151615ffbd47b80e5ecc87a} of world production fixed asset investment is into the metals industry, worth more than US$200 bn. The manufacturing process is relatively resource-intensive and involves products with a low-value density. This industry characterises by high software intensity, and it is becoming increasingly automated, particularly in developed markets. We highlight IoT PaaS software and AGVs as the two most relevant technologies.

Textiles, leather & wearing apparel

Accounting for c.1{3fbfd6f1e6b19884051837dbbbebf333964dd5fac151615ffbd47b80e5ecc87a} of the global manufacturing fixed asset investment the textiles, leather & wearing apparel industry is the smallest industry. Textiles, leather & wearing apparel is the most labour-intensive area. Firms have typically responded to rising wages by moving to lower-cost locations.

Experts do not have a clear-cut answer on whether hardware or software providers will win the race to capture value from higher automation. Hardware makers with large installed bases will have a privileged position, and software providers with big data analytical expertise can make meaningful contributions. In short to medium term, the need for equipment to upgrade capital investment may benefit the hardware makers, but over the long run, more of the technologies profiled will make the manufacturing system more improved, longer lived and ultimately in need of lower capital spending. Speed to market will become more critical and transport costs as a percentage of total costs to increase. The globalisation in recent years is no longer likely to influence decisions, but rather the time to delivery.

Highlights:

- Automation will continue to be the core element in manufacturing with a stronger emphasis on machine-to-machine communication

- The process of production becomes more intelligent from design to services

- Factories of the Future build on a lot of existing technology such as Cloud, Edge and AI and apply it to manufacturing processes

Recent Comments